3D Printing Innovations 2026

3D printing innovations encompass the technological breakthroughs transforming additive manufacturing across aerospace, healthcare, construction, and consumer products. The global 3D printing market reached an estimated $23.41 billion in 2025 according to Fortune Business Insights, growing at a compound annual growth rate exceeding 21% and projected to surpass $136 billion by 2034. From bioprinted tissues that could end organ transplant shortages to 3D-printed homes built in under 48 hours, additive manufacturing has evolved from a prototyping novelty into a production-grade technology that is redefining how humanity designs, builds, and manufactures.

What Is 3D Printing and Why Do Its Innovations Matter?

Three-dimensional printing, formally known as additive manufacturing (AM), is the process of creating solid objects from digital models by depositing material layer by layer. Unlike subtractive manufacturing, which carves shapes from larger blocks and generates substantial waste, 3D printing uses only the material required for the final object, setting a benchmark for resource-efficient production. The European Union has officially classified additive manufacturing as a Key Enabling Technology (KET), recognizing its strategic importance for industrial competitiveness and sustainable development.

The significance of recent 3D printing innovations extends far beyond manufacturing efficiency. The technology now touches virtually every sector of the global economy: aerospace engineers use it to produce lightweight titanium components that improve fuel efficiency by up to 30%, surgeons rely on patient-specific bioprinted implants to achieve better clinical outcomes, and construction companies are printing entire residential communities to address housing shortages. Research indexed in the Web of Science Core Collection shows that over 145,000 original articles on 3D printing have been published as of mid-2025, reflecting the extraordinary pace of scientific advancement in this field.

Several converging factors make 2025–2026 a pivotal moment for additive manufacturing innovation. The cost per printed part has dropped by approximately 40% compared to three years ago, driven by faster print speeds, AI-assisted slicing software, and servo motor precision, according to analysis by Flashforge. Simultaneously, the U.S. Department of Defense FY-2026 budget request includes $3.3 billion for additive-related projects, representing an 83% increase year-over-year, as reported by 3D Printing Industry. These investments signal that governments and corporations alike view 3D printing not as experimental technology but as critical infrastructure for the coming decade.

Who Benefits from 3D Printing Innovations

The reach of additive manufacturing innovations spans a remarkably broad spectrum of stakeholders. Manufacturing engineers leverage faster print speeds and multi-material capabilities to compress product development cycles from months to weeks. Healthcare professionals use bioprinting and patient-specific modeling to improve surgical planning and develop personalized implants. Aerospace and defense contractors rely on metal additive manufacturing to produce flight-critical components with complex geometries impossible through traditional methods. Construction companies adopt large-format concrete printing to build affordable housing faster and with less waste. Small business owners and entrepreneurs access desktop 3D printers with industrial-grade capabilities at consumer-friendly prices. Academic researchers push the boundaries of material science, biomedicine, and sustainable manufacturing through advanced printing techniques. And sustainability advocates champion additive manufacturing’s potential to reduce material waste, enable circular economies, and decentralize production to minimize transportation emissions.

How 3D Printing Works: The Technical Foundation

Additive manufacturing builds three-dimensional objects through a precisely controlled layer-by-layer deposition process. The workflow begins with a digital 3D model, typically created in computer-aided design (CAD) software or derived from medical imaging data such as CT scans or MRIs. Slicing software then divides this model into thousands of thin horizontal layers and generates toolpath instructions, often in G-code format, that guide the printer’s movements.

The core principle is material consolidation: raw material, whether polymer filament, metal powder, liquid resin, or bioink containing living cells, is selectively deposited or solidified at precise coordinates. Each completed layer bonds to the one beneath it, gradually building up the finished object from bottom to top. This additive approach contrasts fundamentally with subtractive manufacturing, such as CNC machining, which removes material from a solid block through cutting, drilling, and milling operations.

Modern 3D printers have evolved dramatically in speed and precision. The CoreXY motion architecture, originally popularized by open-source communities like the Voron project, has become the industry standard for high-speed FDM printers. By reducing the inertial mass of moving components, CoreXY systems commonly achieve accelerations exceeding 20,000 mm/s² and print speeds between 600 and 1,000 mm/s, according to Flashforge’s 2026 industry analysis. At CES 2026, AtomForm announced the Palette 300, a 12-nozzle printer capable of maximum speeds of 800 mm/s with up to 36 colors or 12 materials in a single print, as covered by 3Dnatives.

The Seven Major 3D Printing Technologies

Understanding the landscape of 3D printing innovations requires familiarity with the core technologies that underpin them. Each technology offers distinct advantages depending on the material, resolution, speed, and application requirements.

Fused Deposition Modeling (FDM), also called Fused Filament Fabrication (FFF), is the most widely adopted 3D printing technology. It works by heating thermoplastic filament and extruding it through a nozzle, building objects layer by layer. FDM captured the largest market share in 2024 due to its cost-effectiveness, ease of use, and broad material compatibility, according to Fortune Business Insights. In 2026, servo-direct-drive extrusion systems are replacing traditional stepper motor configurations, delivering torque control with sub-millisecond response times for superior precision.

Stereolithography (SLA) uses an ultraviolet laser to cure liquid photopolymer resin layer by layer. SLA produces parts with exceptionally high resolution and smooth surface finishes, making it ideal for dental aligners, medical devices, and detailed prototypes. The SLA segment generated approximately $3.9 billion in revenue in 2025, according to Global Market Insights.

Selective Laser Sintering (SLS) employs a high-power laser to fuse powdered material, typically nylon or other polymers, into solid structures. SLS produces durable functional parts without the need for support structures, since surrounding powder acts as a natural support during printing.

Direct Metal Laser Sintering (DMLS) and Selective Laser Melting (SLM) are laser powder bed fusion (LPBF) technologies that produce fully dense metal parts from fine metal powders including titanium, aluminum, stainless steel, and nickel superalloys. Metal alloys held 60.5% of aerospace 3D printing market revenue in 2024, according to Mordor Intelligence, underscoring titanium’s essential role in high-temperature aerospace applications.

Multi Jet Fusion (MJF), developed by HP, uses an inkjet array to apply fusing and detailing agents across a bed of nylon powder, which is then fused using infrared energy. MJF is designed for volume production of functional polymer parts with consistent mechanical properties.

Direct Energy Deposition (DED) simultaneously feeds material, either as wire or powder, into a focused energy source such as a laser or electron beam. DED is particularly suited for repairing existing parts and adding features to large components, with NASA using the technology to produce metre-class rocket engine components.

Bioprinting uses specialized extrusion, inkjet, or laser-assisted systems to deposit bioinks containing living cells and biomaterials, creating tissue-like constructs for regenerative medicine, drug testing, and disease modeling. Bioprinting research is advancing rapidly at institutions including Tsinghua University, the Wake Forest Institute for Regenerative Medicine, and labs across Europe and North America.

| Technology | Materials | Resolution | Speed | Best For |

|---|---|---|---|---|

| FDM / FFF | Thermoplastics (PLA, ABS, PETG, nylon, carbon fiber) | 50–400 μm | 60–1,000 mm/s | Prototyping, functional parts, consumer products |

| SLA | Photopolymer resins | 25–100 μm | Moderate | Dental, jewelry, detailed prototypes |

| SLS | Nylon, TPU, polypropylene | 80–120 μm | Moderate | Functional parts, batch production |

| DMLS / SLM | Titanium, aluminum, stainless steel, Inconel | 20–80 μm | Slow–moderate | Aerospace, medical, tooling |

| MJF | Nylon (PA 11, PA 12) | 80 μm | Fast | Volume production, functional parts |

| DED | Metals (wire or powder feed) | 250–1,000 μm | Fast for large parts | Repair, large-format metal structures |

| Bioprinting | Hydrogels, bioinks with living cells | 100–500 μm | Slow | Tissue engineering, drug testing, implants |

The 10 Most Significant 3D Printing Innovations Transforming Industries

1. AI-Integrated Additive Manufacturing

Artificial intelligence is fundamentally reshaping every stage of the 3D printing workflow, from design optimization to real-time quality control. AI algorithms now predict print failures before they occur and make real-time adjustments to ensure optimal results, reducing scrap rates and improving first-pass yield. Siemens’ Additive Manufacturing division reports that orchestration agents are beginning to coordinate specialized purpose-driven AI agents to execute complete manufacturing workflows, fundamentally changing how engineers interact with industrial software, according to insights shared with 3DPrint.com.

In aerospace applications, AI-driven qualification is compressing certification timelines that previously required nearly two years down to eight-to-twelve-month approval routes for printed components. Honeywell has reported 99.7% first-pass yield on turbine shrouds after embedding real-time anomaly detection powered by machine learning, according to analysis by Mordor Intelligence. The FAA and NASA have jointly demonstrated the viability of accepting virtual data generated by AI models that forecast material behavior with 95% accuracy, partially substituting for exhaustive physical testing.

AI Build’s CEO Daghan Cam has noted that in 2025, the software industry reached unprecedented productivity gains by incorporating AI agents as an extension of the workforce, and that further advances in LLM-powered engineering tools will continue to accelerate in 2026. This convergence of AI and additive manufacturing represents one of the most consequential innovations in the field, as it simultaneously lowers costs, improves quality, and reduces the expertise barrier for new adopters.

2. High-Speed Multi-Material and Multi-Color Printing

The ability to print with multiple materials and colors in a single build has moved from experimental capability to mainstream standard. At Formnext 2025, nearly every major FDM release centered on multi-color capabilities, multi-material versatility, high speed, and automation, as reported by Flashforge. The combination of multi-tool configurations with high-speed CoreXY motion architectures has become the new industry benchmark.

Bondtech’s INDX system represents a lightweight revolution in tool-changing technology, enabling printers to switch between multiple extruders with minimal downtime and precise alignment. Prusa Research officially integrated this system into their Core One model at Formnext 2025. Meanwhile, AtomForm’s Palette 300, unveiled at CES 2026, features OmniElement automatic nozzle switching across 12 nozzles, enabling up to 36 colors with claimed filament savings of up to 90%, as reported by 3Dnatives.

Multi-material printing has profound implications beyond aesthetics. In the medical industry, prosthetics are being printed with rigid outer structures for durability and soft inner liners for patient comfort in a single build, eliminating traditional assembly processes. In industrial applications, engineers can produce components that integrate rigid and flexible materials, conductive and insulating sections, or varying levels of strength, all without manual assembly, as documented by UPTIVE.

3. Metal 3D Printing at Scale

Metal additive manufacturing has crossed a critical threshold from laboratory curiosity to production-grade industrial capability. The aerospace 3D printing market alone reached an estimated $5.38 billion in 2025 and is projected to grow at a CAGR of 24.41% through 2035, according to Global Growth Insights. This growth is driven by the technology’s ability to produce lightweight, high-performance components with geometries impossible through traditional casting or machining.

Mastrex, a newly launched brand formed from the merger of American manufacturers Vulcan and Burgmaster, debuted at CES 2026 with the MX Series of laser powder bed fusion (LPBF) metal printers designed to make industrial metal printing more accessible and scalable. Their tiered portfolio ranges from compact machines for precision parts to large-format platforms for volume production, as covered by 3Dnatives.

Meanwhile, paste-based metal extrusion (PME) is emerging as a safer, more accessible alternative to traditional powder-based systems. The Gauss MT90, also showcased at CES 2026, uses PME technology that is safe for offices and labs, eliminating the dust and explosion risks associated with metal powders. The machine features a Quick Start mode, built-in HEPA filtration, and compatibility with stainless steel 316L, copper, titanium, and aluminum, making metal 3D printing accessible to a broader audience of engineers and designers.

3D Systems’ aerospace and defense business is forecast to have grown over 15% in 2025, with expectations exceeding 20% growth in 2026. Revenue from production printing systems and custom metal parts is expected to surpass $35 million in 2026, and the company plans to expand its Littleton, Colorado facility by up to 80,000 square feet, as reported by Engineering.com.

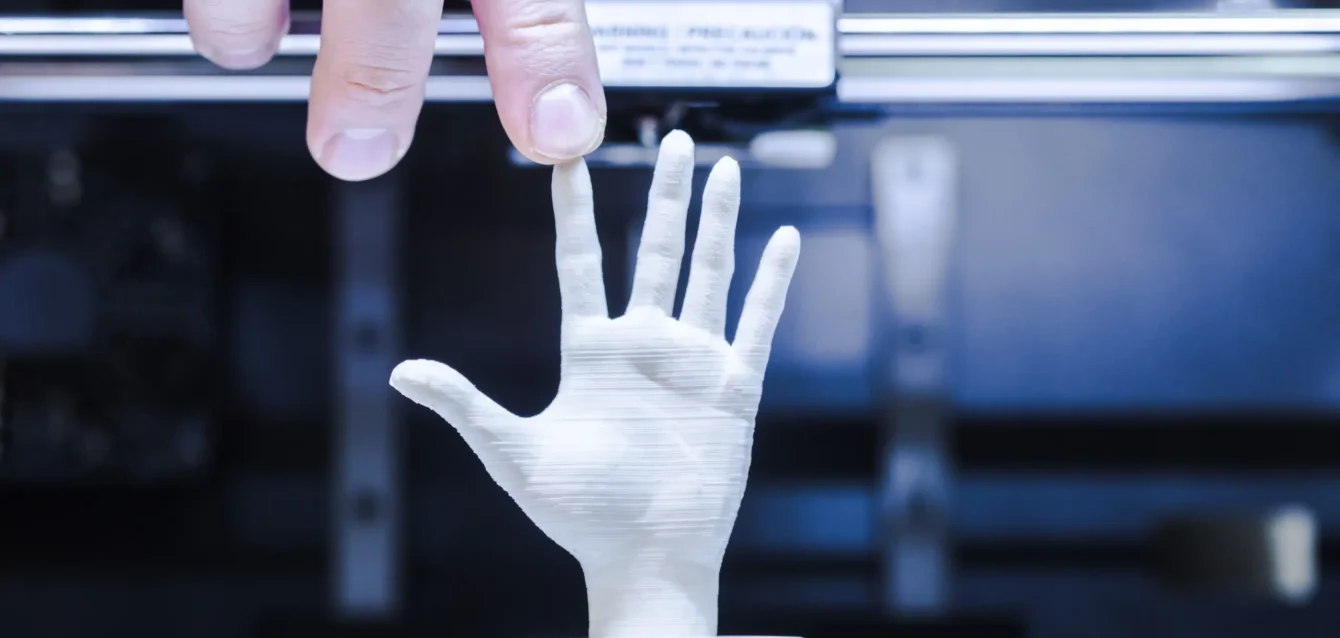

4. Bioprinting and Medical 3D Printing Breakthroughs

Healthcare represents one of the most transformative frontiers for 3D printing innovation. The 3D printing in healthcare market was valued at $1.95 billion in 2025 and is projected to reach $11.22 billion by 2035, growing at a CAGR of 19.12%, according to SNS Insider via GlobeNewsWire. The broader medical 3D printing market is expanding from approximately $2 billion in 2022 to a projected $4 billion in 2026.

In February 2025, Auxilium Biotechnologies achieved a historic milestone by successfully using its 3D bioprinter aboard the International Space Station to print eight implantable medical devices simultaneously in just two hours, as documented by Jaycon. The Auxilium Microfabrication Platform (AMP-1) harnesses the unique properties of microgravity, which allows for uniform material distribution and the creation of finer, more intricate structures that would collapse under Earth’s gravity.

AI-driven innovation in 3D-printed vascular tissues has improved graft success rates and durability by as much as 35%, addressing one of the most persistent challenges in vascular surgery. Researchers at institutions like Tsinghua University are advancing 3D bioprinting for personalized medicine, using computer-aided design software and multiaxis motion platforms to deposit biomaterials and cells with unprecedented accuracy, as published in ACS Biomaterials Science & Engineering.

Current bioprinting research is demonstrating concrete progress in cartilage repair, skin grafts, liver tissue models, and bone tissue engineering, as documented in peer-reviewed research published in PMC/National Library of Medicine. The integration of nanotechnology with bioprinted tissues and microfluidic systems is promoting self-assembly of microvascular networks, a critical step toward printing functional organs. While fully transplantable bioprinted organs remain a long-term goal, functional tissue models for drug testing and disease research are already in clinical use.

5. 3D-Printed Construction and Housing

Construction 3D printing has transitioned from architectural novelty to scalable industrial reality, offering a promising response to global housing shortages. The technology allows large-scale projects to be built up to 50% faster compared to traditional construction while optimizing material use and reducing waste, according to Holcim, one of the world’s largest building materials companies.

In November 2025, Alquist announced a landmark partnership with Walmart and other commercial retailers to deliver more than a dozen 3D-printed construction projects across the United States, marking the largest-scale deployment of 3D-printed commercial building technology in U.S. history, as reported in a PR Newswire press release. The partnership model involves Alquist’s proprietary A1X printers being leased and serviced through a nationwide network, enabling scalable commercial adoption.

In California, the state’s first micro community of 3D-printed homes is under construction in Yuba County by 4dify, using technology from SQ4D. The five-home community serves as a test run before larger developments, including 19 units in Sacramento and 75–100 duplexes in Southern California, as reported by Governing magazine. Houston is also developing its first 3D-printed residential community, with 80 planned homes ramping up through 2026, according to Axios Houston.

Europe is advancing as well. ViliaSprint2 in France is the continent’s largest 3D-printed residential building: an 800 m² three-story social housing residence whose load-bearing walls were printed in just 34 working days using Holcim’s custom fiber-reinforced TectorPrint concrete ink. These developments demonstrate that 3D-printed construction is no longer confined to one-off demonstration projects but is entering full-scale commercial deployment.

| Company | Location | Scale | Technology | Status (2025–2026) |

|---|---|---|---|---|

| Alquist | Nationwide (US) | 12+ commercial buildings | Robotic concrete extrusion | Active deployment, Walmart partnership |

| 4dify / SQ4D | California (US) | 5–100+ residential units | Gantry-based concrete printing | Under construction |

| ICON | Texas (US) | 100-home communities | Vulcan robotic printer | Expanding operations |

| VeroTouch | Colorado (US) | 16 homes + 15 SIP panels | 3D-printed concrete | Under construction |

| Holcim / ViliaSprint2 | France (EU) | 800 m², 3-story social housing | Fiber-reinforced TectorPrint ink | Completed |

| Azure Printed Homes | Los Angeles (US) | ADUs, emergency housing | Recycled plastic + fiberglass | In production, SXSW 2025 Innovation Award |

6. Sustainable and Recycled Materials

Sustainability has become a central driver of 3D printing innovation, with the industry embracing circular economy principles through recycled feedstocks, biodegradable polymers, and energy-efficient processes. The 3D printing materials market alone was valued at $3.19 billion in 2025 and is projected to reach $17.59 billion by 2035, growing at a CAGR of 18.36%, according to Precedence Research.

Research published in PMC/National Library of Medicine indicates that industrial 3D printing could lower total primary energy supply by 2.54–9.30 exajoules and reduce CO₂ emissions by 130.5–525.5 million metric tons. In metal applications, 3D printing can recycle 95–98% of waste material, far exceeding the efficiency of traditional subtractive manufacturing. The layer-by-layer additive process inherently minimizes waste by using only the material needed for the final object, eliminating the excess material removal that characterizes CNC machining.

Azure Printed Homes exemplifies the sustainability innovation frontier: the Los Angeles-based company uses recycled plastic and fiberglass to 3D print modular homes, with units created and installed within four weeks. Azure won the 2025 SXSW Innovation Award for Urban Experience, as reported by 3DPrint.com. In Finland, Ekotekt has created HempCon 3D panels, prefabricated building elements made from hempcrete (hemp fiber plus lime) that are carbon-negative, storing approximately 14 kg of CO₂ per square meter while providing insulation, fire resistance, and pest resistance, as documented by Triangle IP.

Polylactic acid (PLA), derived from renewable resources like corn starch and sugarcane, remains the most widely used sustainable 3D printing material, though it requires industrial composting facilities for proper decomposition. Recycled PET filaments sourced from plastic bottles and ocean waste are gaining market traction, while advanced recycled polymer research at institutions tracked by ASTM and ISO standards bodies is establishing quality benchmarks for circular manufacturing.

7. Software-Defined Manufacturing and Digital Threads

Additive manufacturing software is playing an increasingly central role in the industry’s evolution, with some arguing it has become the primary differentiator between mediocre and exceptional 3D printing outcomes. Bambu Lab’s rapid ascent to become one of the most influential names in consumer 3D printing is partly attributed to its self-identification as a software company that uses code to solve problems previously only solvable through mechanical engineering, according to analysis in 3DPrint.com.

The digital thread concept, a continuous flow of data from design through production to quality assurance, is becoming the organizing principle for industrial additive manufacturing. Cloud-based platforms enable real-time collaboration, file sharing, and remote monitoring across distributed manufacturing networks. IoT sensors embedded in 3D printers provide live performance data for predictive maintenance, reducing costly downtime. These connected ecosystems transform traditional manufacturing workflows into smart factory environments aligned with Industry 4.0 principles.

In LPBF metal printing, software now offers vector-level laser control, enabling experienced operators to differentiate quality, speed, and even microstructure on parts using the same machines as competitors. Providers like Oqton and Dyndrite are integrating this capability with OEM printer manufacturers, creating a new competitive advantage based on software-defined process control rather than hardware specifications alone.

For LPBF specifically, software advances are enabling higher yields and the production of thinner-walled parts. AI-assisted slicing software optimizes toolpaths to minimize material waste, while simulation tools predict thermal stresses and distortion before printing begins. The result is a manufacturing environment where the same dollar investment in hardware produces more and better parts than was possible just two or three years ago.

8. Aerospace and Defense Applications at Industrial Scale

The aerospace and defense sector has emerged as the fastest-growing vertical for additive manufacturing, driven by the imperative for lightweight components, supply chain resilience, and rapid iteration of mission-critical hardware. The FY-2026 U.S. Department of Defense budget request allocates $3.3 billion for additive-related projects, representing an 83% year-over-year increase, as tracked by 3D Printing Industry. The Fiscal Year 2026 National Defense Authorization Act (NDAA) includes provisions restricting foreign-sourced 3D printing systems for Department of Defense programs, accelerating demand for domestic U.S. manufacturing capacity.

Boeing leverages 3D printing to manufacture aircraft components that achieve both weight reduction and cost savings. Airbus utilized 3D-printed titanium brackets and components in the A350 XWB program, contributing to a reported 30% reduction in overall aircraft weight compared to traditional manufacturing methods. NASA is actively developing next-generation thermal management solutions for spacecraft using Direct Metal Printing technology in partnership with Penn State University, Arizona State University, and NASA Glenn Research Center, producing high-performance radiators and heat pipes from titanium and nickel-titanium alloys, as reported by 3D Printing Industry.

GE Aviation’s 3D-printed LEAP fuel nozzle remains a landmark case study: the additive approach consolidated 20 separate parts into a single component that is 25% lighter and five times more durable than its conventionally manufactured predecessor. In the defense arena, field-deployable 3D printers that can operate aboard military vehicles like Ospreys and JLTVs are redefining battlefield logistics, pushing manufacturing sovereignty to the tactical edge. UltiMaker projects that 30% of its total revenue will come from defense contracts by 2026.

The U.S. Air Force Research Laboratory awarded 3D Systems a $7.65 million contract in August 2025 for the GEN-II DMP-1000, a large-format metal 3D printer designed to enhance flight-relevant additive capabilities. In April 2024, Relativity Space signed an $8.7 million agreement with the Air Force Research Lab to advance real-time flaw detection in additive manufacturing, aligning with NDAA mandates to accelerate aerospace component production, according to Mordor Intelligence.

9. Space Manufacturing and Zero-Gravity Printing

The vision of manufacturing in space is no longer science fiction. Following the European Space Agency’s first metal 3D printing operation in space in late 2024, multiple additional tests were conducted throughout 2025 to determine which materials and processes function effectively under microgravity conditions, as reported by 3Dnatives. Auburn University in the United States has announced plans to 3D print semiconductors in zero gravity, with projects anticipated in 2026.

The microgravity environment offers unique advantages for additive manufacturing. Without gravity’s pull, materials distribute uniformly during the printing process, enabling the creation of finer, more intricate structures that would collapse or deform under Earth’s gravitational forces. This advantage is particularly significant for biomedical implants incorporating biological materials or therapeutic agents, where consistency and precision are paramount. Auxilium Biotechnologies’ successful printing of eight implantable medical devices aboard the International Space Station in February 2025 demonstrated the viability of at-scale medical device manufacturing in orbit.

NASA’s broader investment in additive manufacturing for space applications extends to rocket propulsion systems, where 3D-printed engine components reduce both weight and production lead times. NASA publishes open datasets, including failure case studies such as a GRCop-42 combustion chamber porosity incident, accelerating collective learning across the AM ecosystem. This open-data approach shortens the learning curve for the entire industry and de-risks adoption of additive technologies in the most demanding environments known to engineering.

10. Desktop and Consumer 3D Printing Revolution

While industrial 3D printing captures headlines with billion-dollar defense contracts and bioprinted organs, a parallel revolution is unfolding in the desktop and consumer segment. Bambu Lab has become the most influential brand in desktop 3D printing, launching its most advanced machines, the H2D and H2S, in 2025. The Chinese manufacturer combines technical innovation with ease of use and competitive pricing, making high-quality 3D printing accessible to hobbyists, educators, small businesses, and even children, as highlighted in 3Dnatives’ year-in-review.

The desktop segment has been the fastest-growing printer type category, driven by falling hardware costs and dramatically improved software experiences. Features once exclusive to industrial machines, such as enclosed heated chambers, multi-material capability, automatic bed leveling, and AI-powered print monitoring, are now standard on sub-$1,000 consumer printers. This democratization of capability means that product designers, educators, and small manufacturers can access prototyping and short-run production capabilities that would have required $50,000+ machines just five years ago.

The consumer market’s expansion has also catalyzed material innovation, with filament manufacturers now offering engineering-grade materials like carbon-fiber-reinforced nylon, flexible TPU, and ASA for outdoor applications alongside consumer-friendly PLA. The global market for 3D printing materials reached $3.19 billion in 2025, with the polymers segment accounting for 54% of revenue share, according to Precedence Research.

Real-World Applications of 3D Printing Innovations

Automotive Manufacturing and Electric Vehicles

The automotive industry has deployed 3D printing for production-grade parts at increasing scale, particularly for electric vehicles that require unique geometries and lightweight structures. Manufacturers are printing cooling channels, battery enclosures, and complex brackets for limited-run models. Repair shops use 3D printing to produce replacement clips, mounts, and interior fittings for older vehicles lacking original equipment manufacturer support, as documented by Fabbaloo. Hybrid manufacturing systems that combine 3D printing with CNC machining are increasingly common in aerospace-automotive crossover applications, ensuring both additive design freedom and precision finishing.

Nuclear Energy Renaissance

Nuclear energy experienced a significant comeback in 2025, with additive manufacturing playing a central role in accelerating reactor component production. Metal 3D printing has reduced lead times for nuclear components from years to months, enabling the rapid scaling of modular reactor designs. This application represents one of the highest-stakes validations of additive manufacturing reliability and quality control, as covered extensively by Fabbaloo.

Education and Workforce Development

3D printing is increasingly embedded in STEM education curricula at all levels, from elementary schools to doctoral programs. Companies like Bambu Lab have expanded into educational environments, providing tools for hands-on learning in engineering, design, and computer science. Alquist has established partnerships with institutions like Aims Community College to train the next generation of workers in 3D construction printing, recognizing that workforce development is essential for scaling the technology, as noted in their press release.

Food and Consumer Products

While 3D food printing showed signs of slowing in 2025 compared to earlier hype cycles, notable innovations continue. ByFlow’s OPUS 3D Chocolate Shaper is the first compact 3D chocolate printer with built-in tempering, controlling temperature to within 0.1°C across multiple printhead zones for perfectly tempered output, as documented by Triangle IP. In consumer goods, Nike’s Air Max 1000, a shoe predominantly crafted using 3D printing technology, demonstrates how additive manufacturing is entering mainstream product categories.

Best Practices for Adopting 3D Printing Innovations

Successful adoption of additive manufacturing requires a strategic approach that goes beyond simply purchasing a printer. Organizations achieving the best results follow a structured methodology that addresses technology selection, workflow integration, workforce skills, and iterative improvement.

Start with clear use cases. Identify specific applications where 3D printing offers measurable advantages over traditional methods: parts with complex geometries that are expensive to machine, components requiring rapid iteration during development, low-volume production runs where tooling costs are prohibitive, or custom/personalized products. Avoid the common trap of purchasing a 3D printer without a defined application strategy.

Match technology to requirements. The choice between FDM, SLA, SLS, or metal printing technologies should be driven by material requirements, dimensional accuracy, surface finish, mechanical properties, and production volume. A desktop FDM printer is ideal for rapid prototyping of concept models, while an SLS system is better suited for functional end-use parts in small batches.

Invest in design for additive manufacturing (DfAM). Parts designed for traditional manufacturing often cannot be directly 3D printed with optimal results. DfAM principles, including topology optimization, lattice structures, part consolidation, and orientation planning, can dramatically improve printed part performance while reducing material usage and build time.

Build software competence. As the industry shifts toward software-defined manufacturing, proficiency in CAD design, slicing optimization, simulation tools, and digital thread management becomes as important as understanding the hardware. Cloud-based collaboration platforms and AI-assisted design tools can accelerate the learning curve.

Implement quality control processes. For production applications, establish rigorous inspection, testing, and certification workflows. Leverage in-process monitoring, CT scanning, and destructive testing as appropriate to the application’s criticality. Aerospace and medical applications require particular attention to documentation, traceability, and compliance with industry standards from organizations like ASTM International and ISO.

Common Mistakes in 3D Printing Adoption and How to Fix Them

Mistake: Choosing technology based on hype rather than fit. Metal 3D printing is impressive, but many applications are better served by polymer processes at a fraction of the cost. Evaluate actual requirements before investing. → Solution: Conduct a structured needs assessment that maps part requirements (material properties, tolerances, volumes) to available technologies.

Mistake: Neglecting post-processing. Raw 3D-printed parts often require support removal, surface finishing, heat treatment, or assembly. Organizations that underestimate post-processing see increased costs and delayed timelines. → Solution: Include post-processing in total cost and time calculations from the outset. Budget for equipment such as curing stations, sandblasting units, or tumbling media.

Mistake: Overlooking material science. Not all PLA filaments are equal, and not all metal powders produce identical results. Material variability significantly impacts part quality and consistency. → Solution: Source materials from certified suppliers, maintain consistent storage conditions (humidity and temperature control for hygroscopic materials), and establish incoming quality checks.

Mistake: Skipping qualification and testing. Particularly dangerous in aerospace, medical, and structural applications, where untested 3D-printed parts can fail catastrophically. → Solution: Follow industry standards (ASTM F3301 for LPBF metals, ISO/ASTM 52900 for AM terminology) and implement both process qualification and part-level testing protocols.

Mistake: Underestimating the learning curve. 3D printing requires a distinct skillset that differs from traditional manufacturing. Operators need training in machine operation, design for AM, material handling, and quality assurance. → Solution: Invest in structured training programs, leverage manufacturer support resources, and consider partnering with service bureaus for initial projects before bringing capability in-house.

Mistake: Ignoring data security for connected printers. Cloud-connected 3D printers and digital manufacturing workflows create cybersecurity exposure, especially for defense and proprietary industrial applications. → Solution: Implement network segmentation, encrypted file transfer, access controls, and regular security audits for AM systems and their associated digital infrastructure.

The Future of 3D Printing: What’s Changing in 2026 and Beyond

Several trends are converging to shape the next phase of additive manufacturing evolution, supported by substantial investment and accelerating technological maturity.

AI-native manufacturing workflows will become the default. Siemens projects that by 2026, orchestration agents will coordinate specialized AI agents to execute complete workflows for advanced part manufacturing, making complex AM processes as intuitive as natural language prompts. The real limitation, according to Siemens’ Karsten Heuser, will not be technology but the willingness of companies and engineers to adapt.

Regulatory frameworks will mature. Standardized testing methodologies, certification pathways, and quality assurance frameworks for 3D-printed parts are advancing rapidly, particularly for aerospace and medical applications. The America Makes JAQS-SQ certification framework and Nadcap additive manufacturing audits are establishing industry-wide benchmarks for production quality. As regulatory clarity increases, adoption barriers for risk-averse industries will diminish.

Materials innovation will accelerate. Computational material discovery, where AI models predict the properties of new alloy compositions and polymer blends before physical synthesis, is compressing material development timelines. Magnesium alloys, high-entropy alloys, and energetic resins designed specifically for additive processes are expanding the performance envelope. The 3D printing materials market is projected to grow from $3.19 billion in 2025 to $17.59 billion by 2035.

Construction 3D printing will commercialize. With Walmart, Holcim, and multiple residential developers deploying large-format construction printers at scale, the technology is moving beyond pilot phases. Further advances in printable concrete formulations, including carbon-negative hempcrete and biochar-enhanced mixtures, will align construction 3D printing with net-zero building goals.

Bioprinting will reach clinical milestones. While fully transplantable 3D-printed organs remain beyond the immediate horizon, bioprinted skin grafts, cartilage replacements, and tissue models for drug testing are approaching routine clinical use. The bioprinting segment is anticipated to grow at a CAGR of 24.15% through 2033, the fastest-growing application within healthcare 3D printing.

Space manufacturing will expand. With Auburn University planning semiconductor printing in zero gravity and multiple space agencies testing new materials in microgravity, in-orbit manufacturing is progressing from proof-of-concept to operational capability. Long-duration space missions and eventually lunar and Mars habitats will rely heavily on additive manufacturing for tools, spare parts, and structural components.

Frequently Asked Questions About 3D Printing Innovations

What are the most important 3D printing innovations in 2025–2026?

The most significant 3D printing innovations in 2025–2026 span multiple domains. AI integration for real-time quality control and automated workflow management is transforming production efficiency, with systems achieving 99.7% first-pass yield rates. High-speed multi-material printers like the AtomForm Palette 300 enable 36-color printing at 800 mm/s. Bioprinting reached a milestone with the first at-scale medical device manufacturing aboard the International Space Station. Construction 3D printing entered commercial scale with Walmart partnerships and multi-community residential developments. These advances collectively represent the industry’s transition from prototyping to full production capability, supported by a global market projected to exceed $136 billion by 2034.

How big is the global 3D printing market?

The global 3D printing market was valued between $20 billion and $30 billion in 2025, depending on the research methodology and scope of analysis. Fortune Business Insights valued the market at $23.41 billion, while Grand View Research estimated $30.55 billion, and MarketsandMarkets reported $16.16 billion for the broader market. Growth projections consistently indicate a CAGR of 17–24%, driven by expanding adoption in aerospace, healthcare, automotive, and construction sectors. North America holds the largest regional share at approximately 32–40% of the global market.

What is bioprinting and how is it used in healthcare?

Bioprinting is a specialized form of 3D printing that deposits bioinks containing living cells, growth factors, and biomaterials to create functional tissue-like constructs. Three primary techniques are used: extrusion-based bioprinting for large-scale constructs like bone and cartilage, inkjet bioprinting for precise vascular tissue patterns, and laser-assisted bioprinting for high-resolution cell placement. Current clinical applications include patient-specific surgical planning models, custom orthopedic implants, dental devices, and tissue models for pharmaceutical drug testing. Research published in ACS Biomaterials Science & Engineering demonstrates progress toward functional organs, though full organ transplantation remains a long-term goal. The healthcare 3D printing bioprinting segment is growing at a CAGR of 24.15%.

Can 3D printing really build houses?

Yes. 3D-printed construction has moved beyond demonstration projects into commercial-scale deployment. Companies like Alquist are delivering dozen-plus commercial buildings for Walmart and other retailers across the United States, while residential communities of 80–100 3D-printed homes are under development in Texas and California. The technology uses large robotic printers that deposit layers of high-strength concrete to form structural walls, typically completing wall construction in days rather than months. Cost reductions of 10–30% compared to traditional construction have been documented, alongside time savings of up to 50% according to Holcim. Key limitations include the need for traditional methods for roofing, plumbing, and electrical work, as well as evolving building code approvals in many jurisdictions.

How does 3D printing contribute to sustainability?

3D printing advances sustainability through multiple mechanisms. The additive process uses only the material required for the final object, minimizing waste compared to subtractive manufacturing. Metal additive manufacturing can recycle 95–98% of waste material. Research published in PMC/National Library of Medicine estimates that industrial 3D printing could reduce CO₂ emissions by 130.5–525.5 million metric tons. Companies like Azure Printed Homes use recycled plastic and fiberglass to construct modular housing. Decentralized, on-demand production reduces transportation emissions and warehousing needs. Biodegradable materials like PLA from renewable sources are widely available. However, sustainability challenges remain, including energy-intensive processes for metal powder production and limited end-of-life recyclability for some polymer prints.

What materials can be used in 3D printing?

Modern 3D printing supports an expansive range of materials across multiple categories. Polymers include PLA, ABS, PETG, nylon, polycarbonate, TPU (flexible), ASA (UV-resistant), and carbon-fiber-reinforced composites. Metals encompass titanium alloys, stainless steels (316L, 17-4PH), aluminum alloys, Inconel nickel superalloys, cobalt-chrome, copper, and emerging magnesium alloys. Ceramics are used for dental, medical, and high-temperature applications. Resins offer standard, tough, flexible, castable, and biocompatible formulations. Bioinks combine hydrogels (collagen, alginate, gelatin) with living cells for tissue engineering. Construction materials include specialized concrete formulations, recycled polymers, and hempcrete. The materials segment accounted for the largest market share in healthcare 3D printing at 35.42% in 2025.

How fast is 3D printing technology advancing?

The pace of 3D printing advancement is accelerating across multiple performance dimensions. Print speed has increased from typical FDM rates of 40–60 mm/s a few years ago to 600–1,000 mm/s with current CoreXY high-speed architectures. Cost per printed part has dropped approximately 40% over the past three years due to hardware improvements and AI-optimized toolpaths, according to Flashforge analysis. AI-driven qualification has compressed aerospace certification timelines from two years to eight-to-twelve months. Multi-material capabilities have expanded from dual-extrusion to 12-nozzle systems supporting 36 simultaneous colors. Over 145,000 research articles on 3D printing have been published in the Web of Science, reflecting extraordinary scientific momentum. Market growth projections consistently indicate 17–24% compound annual growth through 2035.

What is the role of AI in 3D printing?

AI is transforming 3D printing across the entire value chain. In design, generative AI and topology optimization create part geometries that minimize weight while maximizing structural performance, automatically generating designs that would take human engineers weeks to develop. In process planning, AI-assisted slicing software optimizes print orientations, support structures, and toolpaths to minimize material waste and build time. In production, machine learning models monitor printing in real time, detecting anomalies like porosity, layer delamination, or thermal distortion and making automated corrections. In quality assurance, AI models forecast material behavior with 95% accuracy, enabling regulators to partially substitute virtual testing for physical testing. In material discovery, computational AI predicts the properties of new alloy compositions before synthesis. Siemens anticipates that AI agents will coordinate complete AM workflows by 2026.

How is 3D printing used in aerospace?

Aerospace is the largest and fastest-growing industrial vertical for additive manufacturing. Applications include turbine blades and fuel nozzles (GE Aviation’s LEAP nozzle consolidated 20 parts into one), structural brackets and support components (achieving 30–40% weight reduction), thermal management systems for spacecraft (NASA’s titanium radiators), rocket engine components (produced by Relativity Space and others), and UAV airframes for both defense and commercial applications. The aerospace 3D printing market was valued at approximately $5.38 billion in 2025 and is growing at a 24.41% CAGR. The U.S. DoD has allocated $3.3 billion for additive manufacturing in FY-2026, with field-deployable printers now part of military logistics strategy.

What are the limitations of 3D printing technology?

Despite rapid advancement, 3D printing faces several persistent limitations. Speed remains a constraint for high-volume production, as even fast FDM systems cannot match injection molding throughput for simple geometries at quantities above several thousand units. Material properties for some printed parts may not match wrought or cast equivalents, particularly for fatigue-critical applications. Build volume limits the maximum part size, especially for metal LPBF systems. Surface finish typically requires post-processing to achieve standards comparable to traditional manufacturing. Cost for metal printing systems and materials remains high, with industrial LPBF machines costing $200,000–$2,000,000+. Skilled workforce shortages affect 42% of organizations, according to aerospace industry surveys. Regulatory complexity for medical and aerospace applications adds time and cost to certification processes.

How much does industrial 3D printing cost?

Industrial 3D printing costs vary dramatically based on technology, material, and application. Entry-level professional FDM systems start at $2,000–$10,000. Professional SLA and SLS systems range from $5,000 to $500,000. Industrial metal LPBF systems typically cost $200,000 to over $2,000,000. Material costs add $20–$50/kg for common polymers, $50–$200/kg for engineering polymers, and $100–$800/kg for metal powders depending on alloy composition. However, cost analysis must consider total value: AM reduces tool costs by 80–90% for some applications, achieving over $100,000 in savings per part for low-volume production runs, as highlighted by Global Market Insights. Part consolidation, reduced lead times, weight savings in aerospace applications (translating to fuel efficiency), and elimination of inventory costs all contribute to favorable total cost of ownership despite higher per-unit material costs.

Is 3D printing replacing traditional manufacturing?

3D printing is not wholesale replacing traditional manufacturing but rather complementing and augmenting it in specific high-value applications. For high-volume production of simple geometries (tens of thousands of identical parts), injection molding and CNC machining remain more cost-effective. However, additive manufacturing has become the preferred method for low-to-medium volume production (1–5,000 parts), highly complex geometries that are impossible to machine, rapid prototyping and iterative design, mass customization where each part differs, and on-demand spare parts that eliminate inventory costs. Hybrid manufacturing, which combines 3D printing with traditional finishing processes, is gaining traction in aerospace and automotive sectors. The trend is toward integrated production systems where additive and subtractive methods coexist in optimized workflows, as documented by industry analysts at Grand View Research.

What is the difference between FDM and SLA 3D printing?

FDM (Fused Deposition Modeling) and SLA (Stereolithography) represent two fundamentally different approaches to 3D printing. FDM works by melting thermoplastic filament and extruding it through a heated nozzle, building objects from solid material deposited in lines. SLA uses an ultraviolet laser to selectively cure liquid photopolymer resin in a vat, solidifying material point by point. FDM typically offers lower cost, easier material handling, and broader material selection including engineering plastics and composites. SLA delivers significantly higher resolution (25–100 μm versus 50–400 μm for FDM), smoother surface finishes, and finer detail reproduction, making it preferred for dental applications, jewelry, and highly detailed prototypes. FDM parts are generally stronger for structural applications, while SLA excels in dimensional accuracy and surface quality. FDM captured the largest overall market share in 2024, while SLA generated $3.9 billion in industrial revenue.

How long does it take to 3D print something?

Print time varies enormously based on object size, complexity, technology, resolution settings, and material. A simple desktop FDM prototype the size of a smartphone case might take 2–4 hours. A complex multi-material part could require 12–48 hours. Industrial metal components for aerospace can take 24–72+ hours per build depending on part volume and layer thickness. In construction, wall structures for a full-sized house can be printed in as little as 48 hours of machine runtime, though complete finishing extends the total project timeline to several weeks. The most significant speed improvements in recent years have come from CoreXY architectures and AI-optimized toolpaths, with print speeds increasing from 40–60 mm/s to 600–1,000 mm/s on consumer machines and the cost per part dropping approximately 40% over the past three years, according to Flashforge.

What industries use 3D printing the most?

The leading industries for 3D printing adoption, ranked by market share and growth rate, are aerospace and defense (the largest and fastest-growing industrial segment, with 3D-printed parts in flight-critical and weapon systems), healthcare and medical (prosthetics, implants, surgical guides, bioprinted tissues, and dental applications growing at 19% CAGR), automotive (prototyping, tooling, custom parts for EVs, and aftermarket components), consumer products (footwear, eyewear, electronics accessories, and personalized goods), construction (residential and commercial structures using large-format concrete printing), education and research (STEM learning tools and academic innovation), and energy including nuclear reactor components and oil/gas equipment. The aerospace and defense segment alone has attracted $3.3 billion in U.S. DoD FY-2026 budget allocation as reported by 3D Printing Industry.

How do I get started with 3D printing?

Getting started with 3D printing requires choosing the right entry point for your goals and budget. For hobbyists and learners, a consumer FDM printer in the $200–$600 range (such as models from Bambu Lab, Prusa Research, or Creality) offers excellent capability with minimal learning curve. Pair it with free CAD software like TinkerCAD, Fusion 360, or Blender. For professionals and engineers, evaluate whether FDM, SLA, or SLS best matches your material and precision requirements. Professional-grade systems from Formlabs (SLA), Markforged (continuous fiber), or Bambu Lab (multi-material FDM) offer industrial capabilities at accessible price points. For businesses, consider starting with a service bureau like Protolabs, Xometry, or Shapeways to validate applications before investing in in-house equipment. Regardless of entry point, invest time in learning slicing software (Cura, PrusaSlicer, or Bambu Studio) and design-for-additive-manufacturing principles to maximize results.

Scope, Methodology, and Independence Statement

This guide was produced by the Axis Intelligence Editorial Team through comprehensive research of publicly available industry reports, market analyses, academic publications, corporate announcements, government documents, and technical documentation. Data sources include peer-reviewed research published in ACS Publications, PMC/National Library of Medicine, and ScienceDirect; market intelligence from Fortune Business Insights, Grand View Research, MarketsandMarkets, Mordor Intelligence, Precedence Research, SNS Insider, and Global Market Insights; and industry journalism from 3D Printing Industry, 3DPrint.com, 3Dnatives, and Fabbaloo.

Axis Intelligence maintains complete editorial independence. This publication contains zero affiliate links, zero sponsored content, and zero manufacturer partnerships. No company, product, or service mentioned in this article has paid for inclusion, and no subjective rankings or scores have been assigned. All market data, statistics, and claims are attributed to their original sources with direct links for reader verification.