$1702 Alaska Stimulus Payment

The $1,702 Alaska stimulus payment represents one of America’s most successful experiments in wealth distribution, providing direct cash payments to over 600,000 residents annually through the Alaska Permanent Fund Dividend (PFD). Unlike temporary federal stimulus programs, Alaska’s payment system has operated continuously since 1982, transforming oil wealth into generational prosperity.

This definitive guide explains everything about Alaska’s $1,702 payment: its historical foundation, eligibility requirements, application process, payment schedule, tax implications, and economic impact. Whether you’re a current Alaska resident, considering relocation, or researching universal basic income models, this comprehensive resource provides authoritative information backed by official state data.

Understanding the $1702 Alaska Payment: Not a Stimulus, But Something Better

Before diving into specifics, it’s critical to understand what the $1,702 Alaska payment actually represents—and what it doesn’t.

The $1702 Figure: Breaking Down the 2024 Payment

According to the Alaska Department of Revenue, the $1,702 payment distributed in 2024 consisted of two components:

Base Dividend: $1,403.83

- Calculated from a five-year average of Alaska Permanent Fund earnings

- Represents Alaska’s traditional wealth-sharing mechanism

- Funded by investment returns from the Permanent Fund

Energy Relief Supplement: $298.17

- One-time legislative appropriation for 2024

- Designed to offset high energy costs in Alaska

- Approved by Alaska Legislature through House Bill 53

Total 2024 Payment: $1,702 per eligible resident

Important Distinction: The 2025 Payment Amount

Critical Update: The 2025 Alaska Permanent Fund Dividend has been set at $1,000, not $1,702.

According to the official September 19, 2025 announcement, the Alaska Legislature determined through House Bill 53 that the 2025 dividend would be $1,000 per eligible resident.

Why the decrease?

- No energy relief supplement in 2025

- Legislative budget considerations

- Fund earnings fluctuation

- Political negotiations on dividend formula

This guide covers both the 2024 $1,702 payment (for historical context and those still receiving backdated payments) and the current 2025 $1,000 dividend.

Why It’s Not a “Stimulus Check”

The Alaska PFD differs fundamentally from federal stimulus payments:

Federal Stimulus Checks:

- Emergency economic relief measures

- Temporary programs (ended in 2021)

- Designed to boost spending during recessions

- Funded by deficit spending

- Income-tested with phase-outs

Alaska Permanent Fund Dividend:

- Permanent wealth-sharing program (since 1982)

- Continuous annual payments (43+ years)

- Returns portion of resource wealth to owners (citizens)

- Funded by investment returns from oil revenue savings

- Universal payment regardless of income

The Alaska PFD represents a fundamentally different philosophy: resource dividends as citizen ownership rights rather than government welfare or economic stimulus.

The Alaska Permanent Fund: History and Foundation

Understanding the $1,702 payment requires understanding the revolutionary fund that generates it.

The Birth of a Revolutionary Idea (1968-1976)

1968: The Discovery On March 12, 1968, Atlantic Richfield Company (ARCO) struck oil at Prudhoe Bay on Alaska’s North Slope, discovering what would become North America’s largest oil field. The find transformed Alaska overnight from a resource-dependent territory into a petroleum powerhouse.

1969: The $900 Million Bonus Alaska held the Prudhoe Bay Oil and Gas lease sale in September 1969, generating an unprecedented $900 million in bonuses. This single event produced more revenue than the entire state budget at the time.

The Spending Spree Problem The Alaska Legislature quickly spent the $900 million windfall on infrastructure and social programs. Within years, Alaskans recognized a critical mistake: they had squandered non-renewable resource wealth on one-time expenditures, leaving nothing for future generations.

1974: The Vision Emerges As construction of the Trans-Alaska Pipeline neared completion, forward-thinking Alaskans—led by Governor Jay Hammond—began advocating for a different approach. Hammond, a bush pilot and philosopher-politician, proposed a radical concept: save a portion of oil revenues in a permanent fund that would benefit both current and future Alaskans.

1976: The Constitutional Amendment Alaska’s Constitution prohibited dedicated funds, requiring a constitutional amendment to create the Permanent Fund. On November 2, 1976, Alaskans voted 75,588 to 38,518 (66.3% approval) to amend Article IX, Section 15, establishing:

“At least twenty-five percent of all mineral lease rentals, royalties, royalty sale proceeds, federal mineral revenue sharing payments and bonuses received by the State shall be placed in a permanent fund, the principal of which shall be used only for those income-producing investments specifically designated by law as eligible for permanent fund investments.”

This constitutional protection ensures the fund cannot be raided by the Legislature without another public vote.

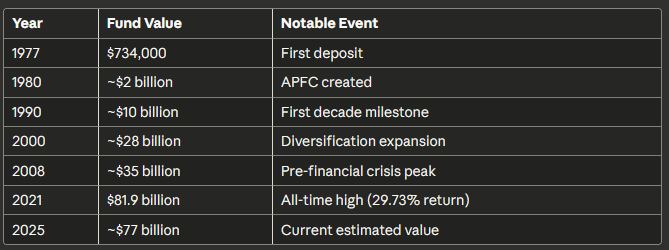

1977: First Deposit On February 28, 1977, the Alaska Permanent Fund received its first deposit: $734,000 in dedicated oil revenues. Those initial funds, through decades of disciplined investing, have grown into one of the world’s most successful sovereign wealth funds.

The Dividend Program Creation (1980-1982)

1980: Alaska Permanent Fund Corporation The Alaska Legislature passed Senate Bill 161, creating the Alaska Permanent Fund Corporation (APFC) as a semi-independent state entity to manage fund investments. The Board of Trustees was entrusted with fiduciary responsibility, insulated from political pressure.

The Distribution Debate With the fund established, Alaskans debated: what should be done with investment earnings?

Options considered:

- Economic development: Use earnings for business loans and infrastructure

- Government operations: Fund state services and reduce taxes

- Direct dividends: Distribute earnings directly to citizens

1982: The Dividend Program Begins Governor Jay Hammond championed direct dividends, arguing that citizens—not politicians—should decide how to use their share of Alaska’s resource wealth. The Alaska Legislature agreed, establishing the Permanent Fund Dividend program.

First Dividend Payment (1982): $1,000 per resident

The dividend immediately became popular across the political spectrum. Conservatives appreciated the limitation on government spending; liberals valued the progressive wealth distribution.

Fund Growth: From Thousands to Billions

According to APFC historical data, the fund’s remarkable growth:

Investment Strategy The fund invests globally across diverse asset classes:

- Public equities (stocks)

- Fixed income (bonds)

- Real estate

- Private equity

- Infrastructure

- Absolute return strategies

- Real assets

Target Return: 5% real rate of return (after inflation) annually

This diversification protects against market volatility while generating consistent returns to fund both dividends and inflation-proofing.

Complete Eligibility Requirements for the $1702/$1000 Alaska Payment

Receiving the Alaska Permanent Fund Dividend requires meeting all eligibility criteria established in Alaska Statutes 43.23.005 and 43.23.008.

The Five Core Eligibility Requirements

1. Alaska Residency Requirement

You must have been an Alaska resident for the entire calendar year preceding the application year.

For 2025 dividend: Must have been Alaska resident for all of 2024 (January 1 – December 31, 2024)

What qualifies as residency? According to Alaska PFD regulations:

- Physical presence: Maintain primary home in Alaska

- Intent to remain: Must intend to remain Alaska resident indefinitely

- No other state residency: Cannot claim residency elsewhere during qualifying year

- Voting registration: Typically registered to vote in Alaska

- Driver’s license: Alaska license (obtaining out-of-state REAL ID can jeopardize eligibility)

“Qualifying Year” Definition: The calendar year before you apply. If applying in 2025, the qualifying year is 2024.

2. Physical Presence Requirement

Must be physically present in Alaska for at least 72 consecutive hours during the qualifying year.

Why 72 hours? This minimal presence requirement acknowledges that some residents (military, students, medical patients) may be absent but maintain legitimate Alaska residency.

When satisfied?

- At any point during qualifying year

- Can be satisfied in single visit

- Must be documented if questioned

3. Allowable Absence Rules

Alaska recognizes that residents may need to leave temporarily without losing residency status. Absences are allowed for specific reasons:

Allowable Absence Categories:

Education:

- Attending accredited educational institution

- Must return to Alaska during breaks or after completion

- Cannot establish residency in another state

Medical Treatment:

- Receiving medical care unavailable in Alaska

- Includes long-term treatment, rehabilitation

- Family member accompanying patient also protected

Military Service:

- Active duty military stationed outside Alaska

- Deployment or temporary duty assignments

- Military dependent family members

Alaska Business:

- Working on Alaska-related business outside state

- Commercial fishing in federal waters

- Oil and gas work on Alaska’s behalf

Family Care:

- Caring for terminally ill or dying family member

- Time-limited to necessary care period

Vacation:

- Temporary vacation travel

- Must return with intent to remain

- Extended international travel may be questioned

Critical Rule: Cannot be absent for more than 180 days total during qualifying year without documented allowable absence reasons.

4. Criminal History Disqualifications

Certain convictions disqualify applicants:

Felony Convictions:

- Convicted of felony during qualifying year

- Not eligible if imprisoned or on parole during qualifying year

- 10-year disqualification for felonies with sentences of one year or more

Misdemeanor Convictions:

- Multiple misdemeanors in qualifying year may disqualify

- Certain serious misdemeanors cause ineligibility

After Disqualification Period:

- Can reapply once disqualification period ends

- Must meet all other eligibility requirements

5. Not Claimed as Dependent

If someone claims you as a dependent on their federal tax return, special rules apply:

Children Under 18:

- Parents/guardians apply on child’s behalf

- Must have eligible Alaska resident sponsor

- Payment goes to parent/guardian

- Child builds eligibility history

Adults 18+:

- Cannot be claimed as dependent by someone outside Alaska

- If claimed by Alaska resident parent, special consideration applies

Special Eligibility Situations

Newborns and Infants:

- Eligible if born in Alaska before January 1 of qualifying year

- Parents apply on their behalf

- Must have eligible sponsor

Adoptees:

- Eligible if adoption finalized and child in Alaska before January 1 of qualifying year

- Adoption documentation required

Foster Children:

- Can be eligible with proper foster care placement

- Foster parent serves as sponsor

- Documentation of placement required

Refugees and Asylees:

- Must receive conditional/permanent status or refugee/asylee status before January 1 of qualifying year

- Must meet all other requirements

Military Members:

- Alaska-stationed military can establish eligibility

- Must demonstrate intent to remain Alaska resident

- Deployment doesn’t affect eligibility if Alaska is permanent duty station

College Students:

- Can maintain eligibility while attending school outside Alaska

- Must return to Alaska during breaks

- Cannot establish residency in school state (voter registration, driver’s license)

Incarcerated Individuals:

- Federal inmates generally ineligible

- State conviction timing determines eligibility

- Cannot be incarcerated as result of criminal conviction during qualifying year

How to Apply for the Alaska PFD: Step-by-Step Process

The application process determines whether you receive the $1,000 (2025) or future dividend payments.

Application Timeline and Deadlines

Application Period: January 1 – March 31 annually

- 2026 Applications: Open January 1 – March 31, 2026 for 2027 dividend

- Deadline: 11:59 PM Alaska Time, March 31

- No extensions: Late applications categorically rejected

- No exceptions: Medical emergencies, military deployment, or other circumstances don’t extend deadline

Critical Deadline Reminder: If you miss the March 31 deadline, you cannot receive that year’s dividend. You must wait until the following year to apply.

Online Application Process (Recommended)

Step 1: Create myAlaska Account

Visit myAlaska.gov to create account:

- Unique username and password

- Email verification required

- Security questions for account recovery

- Two-factor authentication available

Step 2: Access PFD Application Portal

Navigate to pfd.alaska.gov:

- Click “Apply for PFD”

- Login with myAlaska credentials

- System authenticates identity

Step 3: Complete Personal Information

Provide required details:

- Legal name: Must match official documents

- Date of birth: Accurate birth date required

- Social Security Number: Required for all applicants

- Alaska address: Physical address (not P.O. Box) where you reside

- Mailing address: Where check should be sent (can be different)

Step 4: Answer Residency Questions

Critical section determining eligibility:

- Confirm full-year Alaska residency during qualifying year

- List any absences from Alaska with dates and reasons

- Certify intent to remain Alaska resident indefinitely

- Confirm no residency claims in other states

Absence Reporting: Must disclose ALL absences exceeding 30 days:

- Exact dates (month/day/year) of departure and return

- Reason for absence (select from allowed categories)

- Supporting documentation if available

Honesty is mandatory: Falsifying information constitutes fraud, punishable by criminal prosecution and permanent disqualification.

Step 5: Provide Banking Information (Optional but Recommended)

Direct deposit (if selected):

- Routing number: 9-digit bank routing number

- Account number: Full account number

- Account type: Checking or savings

- Account holder name: Must match your name

Paper check alternative:

- Leave banking section blank

- Check mailed to address on file

- Significantly slower (4-8 weeks after direct deposit wave)

Why direct deposit?

- Payments arrive 2-3 weeks faster

- No lost or stolen check risk

- More secure

- Automatic deposit while traveling

Step 6: Upload Supporting Documents

Required or recommended documents:

- Proof of Alaska residency: Utility bills, rental agreements, property records

- Absence documentation: Medical records, school enrollment, military orders

- Identification: Alaska driver’s license or state ID

- Birth certificate (if first-time applicant or young child)

Document requirements:

- Clear, legible scans or photos

- Common formats: PDF, JPG, PNG

- File size limits apply (typically 5MB per document)

Step 7: Review and Submit

Before submitting:

- ✓ Review all information for accuracy

- ✓ Verify banking information correct

- ✓ Confirm all absences disclosed

- ✓ Check required documents attached

- ✓ Read certification statements carefully

Certification: By submitting, you certify under penalty of perjury that all information is true and accurate.

Submit: Click “Submit Application”

Confirmation:

- Receive confirmation number (save this!)

- Confirmation email sent to registered address

- Can print application for records

Paper Application Process (Alternative)

For those without internet access or preferring paper:

Step 1: Obtain Application Form

- Download from pfd.alaska.gov

- Request by phone: 907-465-2326

- Pick up at PFD Division offices

Step 2: Complete Form

- Use blue or black ink

- Print legibly (illegible applications may be rejected)

- Answer all questions completely

- Sign and date

Step 3: Attach Required Documents

- Include copies (not originals) of supporting documents

- Staple or clip securely to application

Step 4: Submit by Deadline

Mail to: Alaska Department of Revenue Permanent Fund Dividend Division PO Box 110460 Juneau, AK 99811-0460

In-person delivery: State Office Building 333 Willoughby Avenue, 11th Floor Juneau, AK 99801

Deadline: Must be postmarked or delivered by March 31, 11:59 PM Alaska Time

Processing time: Paper applications take 2-4 weeks longer than online submissions.

After Applying: Checking Status

myPFD Portal: Login to check application status at any time:

- Pending: Application received, under review

- Eligible-Not Paid: Approved, awaiting payment distribution

- Paid: Payment issued with date and method

- Denied: Application rejected with reason

Status Updates:

- System updates weekly during review period

- Email notifications for major status changes

- Can track payment issuance date

If Denied:

- Reason for denial provided

- Instructions for appeal process

- 60-day window to appeal decision

- Must provide additional documentation to overturn

Payment Schedule: When You’ll Receive Your $1702/$1000 Alaska Dividend

Understanding the payment schedule helps you plan finances and anticipate when funds arrive.

2024 Payment Schedule ($1,702 Dividend)

The 2024 dividend of $1,702 was distributed in multiple waves throughout 2024 and early 2025 for those with delayed or “Eligible-Not Paid” status:

Major Distribution Dates (2024 dividend):

- October 2024: Primary mass distribution

- November 2024: Second wave

- May 15, 2025: Applications in “Eligible-Not Paid” status as of May 7, 2025

- June 18, 2025: Applications eligible as of June 11, 2025

- July 17, 2025: Applications eligible as of July 9, 2025

- August 21, 2025: Applications eligible as of August 13, 2025

- September 11, 2025: Applications eligible as of September 3, 2025

2025 Payment Schedule ($1,000 Dividend)

According to the Alaska Department of Revenue official announcement, the 2025 PFD payment schedule:

First Wave – October 2, 2025:

- Eligibility: Applications filed electronically, requested direct deposit, and in “Eligible-Not Paid” status as of September 18, 2025

- Payment method: Direct deposit only

- Estimated recipients: ~400,000 Alaskans

- Date funds available: October 2, 2025

Second Wave – October 23, 2025:

- Eligibility: All 2025 applications in “Eligible-Not Paid” status as of October 13, 2025

- Payment method: Direct deposit AND paper checks

- Includes: Both electronic and paper applications

- Date: October 23, 2025

- Estimated recipients: ~200,000+ additional Alaskans

Subsequent Monthly Distributions: According to PFD Division policy, additional waves for late-approved or corrected applications:

- November 20, 2025: Applications eligible as of November 12, 2025

- December 18, 2025: Applications eligible as of December 10, 2025

- January 15, 2026: Applications eligible as of January 7, 2026

Ongoing distributions: Continue monthly until all eligible applications paid.

Payment Methods and Timing

Direct Deposit:

- Funds electronically transferred to bank account

- Appears as “State of Alaska PFD” or similar designation

- Available immediately upon transfer (usually overnight)

- Timing: Business day of scheduled distribution

- No physical check to deposit

Paper Check:

- Mailed via U.S. Postal Service

- Check dated on distribution date

- Delivery time: 5-10 business days after mailing

- May be delayed by postal service issues

- Must deposit at bank or credit union

Prepaid Debit Card (rare):

- Some recipients receive Economic Impact Payment (EIP) cards

- Functions like regular debit card

- Can withdraw at ATMs or use for purchases

- No fees for basic usage

What if Payment Doesn’t Arrive?

Step 1: Check Status

- Login to myPFD portal

- Verify payment status shows “Paid”

- Note payment date and method

Step 2: Wait Appropriate Time

- Direct deposit: Wait 3-5 business days after payment date

- Paper check: Wait 10-14 business days after payment date

Step 3: Verify Banking/Address Information

- Confirm bank account information correct in myPFD

- Verify current mailing address on file

- Update if changed since application

Step 4: Contact PFD Division

Phone: 907-465-2326

- Hours: Monday-Friday, 10:00 AM – 4:00 PM Alaska Time

- High call volume during distribution periods

- Be prepared to verify identity

Email: dor.pfd.payments@alaska.gov

- Include name, confirmation number, date of birth

- Describe issue clearly

- Response time: 5-10 business days

Step 5: Payment Reissue If payment lost or not received:

- PFD Division investigates

- Can cancel and reissue check

- May require affidavit of non-receipt

- Reissued payments take 4-6 weeks

Tax Implications of the $1702 Alaska Payment

Understanding tax obligations prevents costly surprises when filing returns.

Federal Tax Treatment

The Alaska PFD is federally taxable income.

According to IRS regulations:

- Reported on: Form 1040, Schedule 1, Line 8z (Other Income)

- Taxable amount: Full payment amount ($1,702 for 2024, $1,000 for 2025)

- Tax rate: Your marginal federal income tax rate

- No withholding: Taxes not automatically withheld unless you request

Why it’s taxable: The IRS classifies the PFD as income from state and local tax refunds, credits, or offsets, which are generally taxable.

Form 1099-MISC: Alaska does NOT issue Form 1099-MISC for PFD payments. You must self-report the income when filing your federal return.

How to report:

- Obtain your total PFD payment amount (from myPFD portal or confirmation letter)

- Enter on Form 1040, Schedule 1, Line 8z

- Write “Alaska PFD” as description

- Include in your total income calculation

Tax liability example:

Single filer, $50,000 AGI, 22% tax bracket:

- PFD received: $1,702

- Federal tax owed: $1,702 × 22% = $374.44

Family of four, $100,000 AGI, 22% tax bracket:

- Total PFD (4 × $1,702): $6,808

- Federal tax owed: $6,808 × 22% = $1,497.76

Alaska State Tax Treatment

The Alaska PFD is NOT subject to Alaska state income tax.

Alaska has no state income tax, so the dividend creates no state tax liability. This is one of Alaska’s significant advantages—citizens receive the full benefit without state taxation reducing the payment.

Optional Voluntary Withholding

Alaskans can request voluntary federal tax withholding from PFD payments to avoid owing taxes when filing.

Withholding Rates Available:

- 5%

- 10%

- 15%

- 20%

- 25%

How to request withholding:

- Select withholding percentage during application process

- Complete IRS Form W-4V (Voluntary Withholding Request)

- Submit to PFD Division with application

Example with withholding:

$1,702 payment with 10% withholding:

- Withholding amount: $170.20

- Net payment received: $1,531.80

- Amount withheld sent to IRS on your behalf

Advantages of withholding:

- Avoid large tax bill when filing

- Spread tax burden throughout year

- Easier budgeting and planning

Disadvantages:

- Immediate reduction in payment received

- May over-withhold (requiring refund filing)

- No interest earned on withheld amounts

Tax Planning Strategies

Strategy 1: Set Aside Tax Reserve

- Calculate estimated tax liability when receiving payment

- Immediately transfer tax amount to savings

- Pay when filing taxes

- Prevents spending money you’ll owe

Strategy 2: Increase Withholding from Wages

- Adjust W-4 withholding at job to cover PFD tax

- Spread tax payment over entire year

- Smoother cash flow management

Strategy 3: Estimated Tax Payments

- Make quarterly estimated tax payments

- Include PFD in calculations

- Avoid underpayment penalties

Strategy 4: Tax-Advantaged Uses

- Contribute to Traditional IRA (reduces taxable income)

- Fund Health Savings Account (HSA)

- Make charitable contributions

- Effectively reduces net tax liability

Impact on Federal Benefits

Generally does NOT affect:

- Social Security retirement benefits

- Medicare eligibility or premiums

- Veterans benefits

- Federal pension payments

MAY affect means-tested programs:

- Supplemental Security Income (SSI): PFD counts as income but excluded for 12 months if saved

- Medicaid: PFD counted as income in eligibility calculations

- SNAP (food stamps): Counts as income

- Section 8 housing: Counted in annual income

Important timing consideration: For needs-based programs, PFD counts as income in the month received. Spending it quickly reduces impact on asset tests.

Economic Impact: How the $1702 Payment Affects Alaska

The Alaska PFD represents one of the world’s longest-running universal basic income experiments, providing decades of economic data.

Direct Financial Impact on Households

Aggregate Annual Distribution:

- 2024: ~650,000 eligible Alaskans × $1,702 = $1.1 billion distributed

- 2025: ~650,000 eligible Alaskans × $1,000 = $650 million distributed

Per Capita Impact: According to economic studies, the PFD represents:

- 3-5% of per capita income for average Alaskan

- Higher percentage for low-income residents (up to 15-20% of annual income)

- Family of four receives: $4,000 (2025) or $6,808 (2024)

Poverty Reduction Effects:

Research from the University of Alaska Institute of Social and Economic Research found:

- PFD reduces poverty rate by 2-3 percentage points annually

- Particularly benefits rural Alaska where living costs are 2-3x urban Alaska

- Helps indigenous Alaskan communities disproportionately

Consumer Spending Patterns

Studies show Alaskans spend PFD payments primarily on:

- Essential expenses (40-50%):

- Food and groceries

- Housing (rent/mortgage)

- Utilities (especially heating fuel)

- Healthcare and medication

- Debt reduction (15-25%):

- Credit card balances

- Personal loans

- Medical debt

- Student loans

- Savings (10-15%):

- Emergency funds

- College savings (529 plans)

- Retirement contributions

- Down payment funds

- Major purchases (10-15%):

- Appliances and electronics

- Vehicle repairs/purchases

- Home improvements

- Winter supplies

- Discretionary spending (10-15%):

- Travel and vacations

- Entertainment

- Holiday gifts

- Charitable donations

Economic Multiplier Effect: Each dollar of PFD generates an estimated $1.20-$1.50 in economic activity through circulation in local economies.

Business and Retail Impact

October Sales Spike: Alaska retailers experience significant sales increases during October distribution:

- Auto dealers: 20-30% sales increase

- Furniture stores: 25-35% sales increase

- Electronics retailers: 30-40% sales increase

- Department stores: 15-25% sales increase

Small Business Benefits: Local businesses particularly benefit:

- Rural stores see immediate inventory turnover

- Service businesses get deferred maintenance projects

- Contractors book winter work

- Restaurants and entertainment venues see increased traffic

Housing Market Effects

Rent Payment Security: The PFD provides critical rent payment buffer for low-income Alaskans:

- Helps catch up on late payments

- Provides deposit money for housing

- Enables housing transitions (moving to better situations)

Homeownership Support:

- Down payment savings accumulation

- Property tax payments

- Home improvement financing

- Heating fuel prepayment (critical in Alaska winters)

Income Inequality Reduction

The universal nature of the PFD (everyone receives same amount regardless of income) makes it progressively redistributive:

High-income household ($200,000/year):

- Family of four receives $6,808 (2024)

- Represents 3.4% of income

Low-income household ($30,000/year):

- Family of four receives $6,808 (2024)

- Represents 22.7% of income

Gini Coefficient Impact: Studies show the PFD reduces Alaska’s income inequality by approximately 2-3 Gini points, making Alaska one of the most economically equal U.S. states.

Long-Term Economic Sustainability

Fund as Revenue Generator: The Alaska Permanent Fund has become the state’s primary source of unrestricted general fund revenue:

- FY 2021: Permanent Fund transfer represented 71% of unrestricted general fund revenue

- FY 2025 (projected): Approximately 67-72% of UGF revenue

Percent of Market Value (POMV) Draw: Alaska uses a 5% POMV rule to determine annual withdrawals:

- Based on average market value of prior 5 years

- Designed to be sustainable indefinitely

- Provides predictable revenue for state operations

Competing Priorities: Ongoing tension between:

- Dividend payments to citizens

- State government funding (education, infrastructure, services)

- Inflation-proofing the fund

- Growing principal for future generations

Criticisms and Concerns

Arguments Against the Dividend:

- Opportunity Cost:

- Money could fund education, infrastructure

- Direct citizen payments vs. public investment trade-off

- Consumerism Encouragement:

- Critics argue it promotes spending over long-term investment

- Concerns about alcohol/substance abuse purchases

- Political Manipulation:

- Dividend amounts become political football

- Legislators use dividend promises to win elections

- Dependency Creation:

- Some argue Alaskans become dependent on annual payment

- May discourage work or relocation

Counterarguments:

- Citizen Ownership Philosophy:

- Resources belong to citizens, not government

- Direct distribution most equitable use

- Economic Stimulus:

- Immediate local economic injection

- Supports rural communities that government services don’t reach effectively

- Poverty Reduction:

- Measurable decreases in poverty rates

- Provides safety net for vulnerable populations

- Political Protection:

- Strong public support protects fund from legislative raids

- Citizens actively defend the dividend

Comparing Alaska’s Model to Other Universal Basic Income Programs

Alaska’s PFD represents the longest-running universal basic income (UBI) program in North America, providing valuable lessons for UBI advocates worldwide.

Key UBI Characteristics Present in Alaska PFD

- Universal: Everyone receives payment regardless of income

- Unconditional: No work requirements or behavioral conditions

- Individual: Each person receives payment (not household-based)

- Regular: Annual predictable payment

- Cash transfer: Recipients choose how to spend

Other UBI Experiments and Comparisons

Finland UBI Experiment (2017-2018):

- €560/month to 2,000 unemployed individuals

- Results: Improved wellbeing, no reduction in employment

- Alaska advantage: Longer-term data (43+ years vs. 2 years)

Stockton, California SEED (2019-2021):

- $500/month to 125 residents

- 18-month pilot program

- Alaska advantage: Universal vs. targeted; permanent vs. experimental

Kenya GiveDirectly:

- $22/month to rural villagers

- 12-year program commitment

- Alaska advantage: Funded by resource wealth, not donations

Canada Mincome Experiment (1974-1979):

- Guaranteed minimum income in Manitoba

- Results showed health improvements, education gains

- Alaska advantage: Politically sustainable; didn’t end due to political opposition

Lessons from Alaska for UBI Policy

What Works:

- Resource-funded: Funded by investments, not taxation (more politically palatable)

- Constitutional protection: Amendment requires public vote to change

- Universal support: Popular across political spectrum

- Simplicity: Easy to understand and administer

- Transparency: Fund management publicly reported

What Doesn’t Work:

- Amount volatility: Varying dividend amounts create planning difficulty

- Political battles: Annual legislative fights over dividend vs. services

- Sustainability questions: Long-term balance between uses still debated

Replicability Challenges:

- Most places lack Alaska’s natural resource wealth

- Requires long-term investment horizon (40+ years to reach Alaska’s scale)

- Political will to establish constitutional protections

Common Questions About the $1702 Alaska Payment

Can non-residents receive the Alaska PFD?

No. You must be a resident for the entire calendar year preceding your application. First-year Alaska residents cannot receive the dividend for that first year, regardless of when they moved to Alaska.

Example: If you move to Alaska in June 2025, you cannot apply for the 2026 dividend (paid in 2026 for 2025 residency). You could first apply in January 2027 for the 2027 dividend, after establishing full-year 2026 residency.

Can I receive the PFD if I’m temporarily living outside Alaska?

It depends on the reason and duration. If you’re outside Alaska for allowable absence reasons (education, medical care, military service, Alaska business), you may maintain eligibility. However:

- Cannot be absent more than 180 days without documented allowable reason

- Must maintain intent to return to Alaska

- Cannot establish residency elsewhere (voter registration, driver’s license in other state disqualifies you)

Do children receive the Alaska PFD?

Yes! Children of all ages receive the same payment as adults, from newborns to teenagers. Parents or guardians apply on behalf of minor children. The payment typically goes to the parent/guardian to use for the child’s benefit.

Example: A family of four (two adults, two children) receives:

- 2024: $1,702 × 4 = $6,808

- 2025: $1,000 × 4 = $4,000

Can I collect back payments if I didn’t apply in previous years?

No. You must apply during the January 1 – March 31 window each year. If you miss the deadline, you forfeit that year’s dividend permanently. There is no mechanism to collect “back payments” for years you didn’t apply.

However, if you applied but your application was delayed or denied, and you later resolve the issue, you can receive backdated payments for those applications.

How much is the 2026 Alaska PFD?

The 2026 dividend amount will be determined by the Alaska Legislature during the 2026 legislative session (January-May 2026) and announced in September 2026. The amount depends on:

- Alaska Permanent Fund investment returns for prior years

- Legislative budget negotiations

- Political priorities and compromises

- Economic conditions

Historical range: $878 (2012 low) to $2,072 (2015 high).

Can the government take my PFD for debts?

Federal debts: Yes. The federal government can offset PFD payments for:

- Unpaid federal taxes

- Defaulted federal student loans

- Federal agency debts

- Child support arrearages (through federal enforcement)

State debts: Alaska can offset for state debts (taxes, court judgments, etc.)

Private creditors: Generally cannot garnish PFD directly, but once deposited in your bank account, funds become subject to normal garnishment rules.

Protection strategy: Open separate account solely for benefits; many states offer enhanced garnishment protection for benefit-only accounts.

Is the Alaska PFD really the highest in 2024 at $1,702?

No. The 2024 PFD of $1,702 was actually below historical highs:

- 2015: $2,072 (all-time high)

- 2008: $2,069 (including one-time resource rebate)

- 2022: $3,284 (including one-time energy relief of $650)

The 2024 amount was elevated due to the $298.17 energy supplement. The base dividend of $1,403.83 was moderate by historical standards.

Will Alaska’s PFD program continue forever?

While impossible to guarantee, several factors suggest durability:

Factors supporting continuation:

- Constitutional protection (requires public vote to eliminate)

- Overwhelming public support (81%+ approval)

- Strong bipartisan backing

- Fund continues growing (now ~$77 billion)

- Generates sufficient returns to sustain payments

Potential threats:

- State fiscal crisis forcing raid on fund

- Environmental pressures reducing future oil revenues (though fund is already established)

- Political change in priorities

- Constitutional convention that could alter protections

Likelihood: The program will almost certainly continue in some form for decades, though exact dividend amounts will fluctuate.

Can I lose my PFD eligibility permanently?

Yes, in certain circumstances:

- Fraud: Providing false information on application results in permanent ban

- Serious felonies: Certain convictions create lengthy or permanent disqualification

- Residency loss: If you permanently move from Alaska, you lose eligibility (but can regain if you return and reestablish residency)

For most temporary issues (address errors, documentation problems), you can correct and reapply.

How do I update my information after applying?

Before payment distribution:

- Login to myPFD portal

- Update address, banking information

- Changes process within 1-2 weeks

After payment issued:

- Too late to change for that year’s payment

- Update for future years in myPFD account

Critical dates:

- Address/banking changes: Update by September 1 for October payments

- After that, changes may not process before distribution

What happens if I die before receiving my PFD?

If you die after applying but before receiving payment:

- Payment goes to your estate

- Executor/personal representative claims on your behalf

- Same tax treatment applies

If you die before applying:

- Cannot receive that year’s dividend

- Family cannot apply posthumously

Conclusion: The $1702 Alaska Payment as Economic Model

The $1,702 Alaska Permanent Fund Dividend represents more than a simple cash payment—it embodies a revolutionary approach to resource wealth management and citizen ownership. For over four decades, Alaska has demonstrated that sharing natural resource wealth directly with citizens is not only possible but politically sustainable and economically beneficial.

Key takeaways:

- 2024 payment: $1,702 (including energy supplement)

- 2025 payment: $1,000 (base dividend only)

- Future payments: Will vary annually based on fund performance and legislative decisions

- Eligibility: Full-year Alaska residency during qualifying year

- Application deadline: March 31 annually (no exceptions)

- Tax treatment: Federally taxable; Alaska state tax-exempt

- Economic impact: Reduces poverty, stimulates local economies, improves wellbeing

The Alaska model’s global significance:

As nations and communities worldwide grapple with automation, inequality, and resource management questions, Alaska’s 43-year experiment provides evidence that:

- Universal basic income is administratively feasible

- Direct cash transfers effectively reduce poverty

- Resource dividends can be politically sustainable

- Citizens can be trusted to use funds responsibly

For prospective Alaska residents:

The PFD should not be the sole reason to move to Alaska—the state’s high cost of living, extreme weather, and geographic isolation present significant challenges. However, for those attracted to Alaska’s unique lifestyle, the dividend provides meaningful financial support.

For current Alaskans:

Protect and value the PFD system. The constitutional amendment and careful fund management that created this program represent visionary policy-making. Active civic engagement ensures the dividend continues benefiting all Alaskans for generations to come.

For policy researchers:

Alaska demonstrates that resource-backed universal basic income can work at scale over decades. The model offers insights for designing sustainable, equitable wealth-sharing systems worldwide.

The $1,702 Alaska payment isn’t just money—it’s a statement about who owns natural resources and how that ownership should be expressed. In Alaska, the answer is clear: resources belong to the people, and the people should directly benefit from their wealth.