PLTR Stock Current Financial Performance and Q4 2025 Earnings Context

PLTR stock refers to the publicly traded equity securities of Palantir Technologies Inc. (NASDAQ: PLTR), a data analytics and artificial intelligence software company that provides operational platforms for government defense agencies and commercial enterprises. The stock represents fractional ownership in Palantir’s business operations, which generate revenue through multi-year software subscriptions for its Gotham, Foundry, Apollo, and Artificial Intelligence Platform (AIP) products. In institutional investment and public equity contexts, PLTR stock is analyzed as a high-growth, high-valuation software equity positioned within the artificial intelligence infrastructure sector.

Table of Contents

Core Characteristics and Investment Framework

Palantir Technologies operates as a dual-segment software provider serving both government defense operations and commercial enterprise clients. The company’s revenue model centers on long-term contracts with embedded operational dependencies that create high switching costs and recurring revenue stability.

Market Position and Business Model:

- Dual Revenue Streams: Government segment (Gotham platform) and commercial segment (Foundry/AIP platforms) with distinct growth trajectories and margin profiles

- Subscription Architecture: Multi-year contracts ranging from $1 million to $10 billion with annual recurring revenue (ARR) expansion mechanisms

- High Switching Costs: Deep integration into mission-critical operations creates structural lock-in for defense, intelligence, and enterprise customers

- Platform Economics: Software-centric model with gross margins exceeding 80% and operating margins reaching 51% in late 2025

- Government Contract Dominance: Long-term agreements including $10 billion U.S. Army Enterprise Agreement and $1.3 billion Maven Smart System contract

- AIP Bootcamp Model: Five-day customer acquisition process that replaced traditional multi-month sales cycles, reducing customer acquisition costs

- S&P 500 Inclusion: Added to index in September 2024, creating systematic passive capital inflows from index funds and institutional rebalancing

Current Financial Performance and Q4 2025 Earnings Context

As of February 3, 2026, Palantir reported fourth-quarter 2025 financial results that exceeded Wall Street expectations across all key metrics. The earnings report, released after market close on February 2, 2026, demonstrated accelerating revenue growth and expanding profitability.

Fourth-quarter revenue reached $1.41 billion, representing 70% year-over-year growth and surpassing analyst consensus estimates of $1.33 billion. Adjusted earnings per share of $0.25 exceeded the projected $0.23, marking an increase from $0.14 in the year-ago period. Total annual revenue for fiscal 2025 reached approximately $4.48 billion.

U.S. commercial revenue grew 137% year-over-year to $507 million, while U.S. government revenue increased 66% to $570 million. The commercial segment’s triple-digit growth reflects successful diversification beyond the company’s historical government contract base. Total contract value closed during the quarter reached $4.26 billion.

Forward guidance provided for fiscal 2026 projects revenue between $7.18 billion and $7.20 billion, significantly above the previous analyst consensus of $6.28 billion. First-quarter 2026 revenue guidance of $1.532 billion to $1.536 billion exceeded estimates of $1.32 billion. The company projects U.S. commercial revenue growth of at least 115% for the full year 2026 and adjusted free cash flow of approximately $3.93 billion to $4.13 billion.

According to financial data from market research institutions, the company maintains a debt-free balance sheet with cash reserves exceeding $4.5 billion, providing substantial capital for research and development or potential strategic acquisitions.

Valuation Metrics and Market Capitalization Analysis

PLTR stock trades at valuation multiples that significantly exceed software industry averages, reflecting investor expectations for sustained high-growth performance and market leadership in AI software infrastructure.

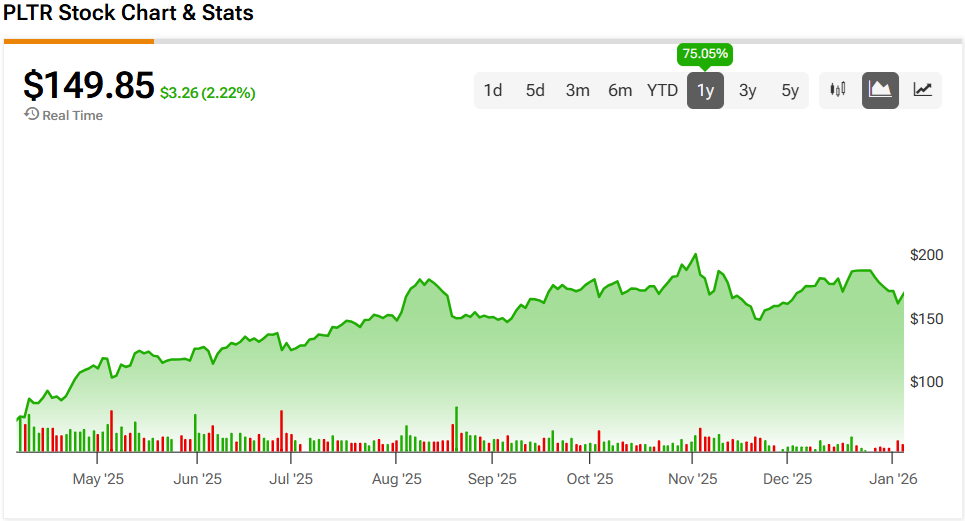

As of February 3, 2026, the stock price closed at approximately $154.34, giving Palantir a market capitalization of $368 billion. The 52-week trading range extends from a low of $66.12 to a high of $207.52 reached in November 2025.

Current valuation metrics position PLTR among the most expensive software equities. The trailing P/E ratio stands at approximately 342-427, while the forward P/E for fiscal 2026 ranges from 166 to 240. The price-to-sales ratio reaches approximately 70 times projected 2026 revenue, representing one of the highest valuations for a company of Palantir’s scale.

Research from valuation analysis platforms indicates that the forward P/E of 173 implies investors are pricing in sustained earnings growth above 50% annually for multiple years. Analyst consensus ratings reflect divergent views: six assign “Buy,” ten “Hold,” and two “Sell,” with price targets ranging from $50 to $255.

Institutional Ownership and Market Dynamics

Institutional ownership of PLTR stock stands at 56.22%, reflecting index funds, active equity managers, and quantitative strategies. According to market data tracked by financial platforms, JPMorgan reduced its position by 32%, while T. Rowe Price decreased holdings by 24%. Conversely, 497 institutional investors added shares in the most recent quarter.

The stock exhibits high retail interest with daily volumes averaging 41.74 million shares. The beta of 2.99 indicates volatility three times the broader market. Options implied volatility approximates 9% for earnings periods. S&P 500 inclusion creates systematic passive buying pressure from index funds.

Government Contracts and Defense Sector Positioning

Palantir’s government business operates as a strategic vendor to U.S. defense, intelligence, and homeland security agencies. The company’s platforms are embedded in mission-critical operations across multiple federal departments and combatant commands.

The $10 billion U.S. Army Enterprise Agreement, announced in July 2025, consolidates 75 separate contracts into a single ten-year framework. According to official Army announcements, the agreement provides volume-based discounts and eliminates contract-related fees and reseller pass-through costs. The Army’s Chief Information Officer stated the arrangement represents “a pivotal step in the Army’s commitment to modernizing capabilities while being fiscally responsible.”

The Maven Smart System contract with the Department of Defense reached a ceiling value exceeding $1.3 billion after a $795 million increase in May 2025. Research from defense procurement analysis indicates that more than 20,000 active Maven users operate across 35 military service and combatant command software tools in three security domains. The National Geospatial-Intelligence Agency confirmed that the Maven user base more than doubled between January and May 2025.

Additional government contracts include a $448 million agreement with the U.S. Navy announced in December 2025 to accelerate shipbuilding production, and a £1.5 billion defense deal with the United Kingdom reported in September 2025. The company also provides systems to U.S. Immigration and Customs Enforcement (ICE) and maintains contracts with NATO for the Maven Smart System NATO variant supporting Allied Command Operations.

Government revenue growth of 66% year-over-year in Q4 2025 reflects expansion within existing agency relationships rather than dependency on new customer acquisition. The land-and-expand model within government accounts creates predictable annual recurring revenue with minimal churn risk, as agencies typically add users, modules, and operational workflows over time once platforms are deployed.

Artificial Intelligence Platform (AIP) Commercial Adoption

The Artificial Intelligence Platform represents Palantir’s primary growth driver in the commercial market segment. AIP integrates large language models (LLMs) within secure, structured data environments to enable autonomous decision-making agents and operational workflows.

AIP’s architecture comprises three core components: the data integration layer (Foundry), the continuous delivery system (Apollo), and the LLM orchestration framework (AIP). According to Palantir’s technical documentation, the platform provides tools including AIP Logic, AIP Agent Studio, and AIP Evals that enable production-ready AI-powered workflows without requiring extensive machine learning expertise from end users.

The go-to-market strategy centers on “AIP Bootcamps,” which compress the traditional enterprise software sales cycle from months to five days. Potential customers participate in intensive workshops where they build functional AI use cases using their own data. This try-before-you-buy model at scale has reduced customer acquisition costs while accelerating conversion of pilot programs into enterprise-wide licenses.

Commercial customer adoption spans multiple industry verticals including manufacturing, healthcare, financial services, energy, and logistics. Notable implementations include supply chain optimization systems that reduce problem resolution time from 15-person days to five minutes, according to operational case studies. The platform’s ability to demonstrate measurable return on investment within days addresses a primary concern among enterprises regarding AI capital expenditure justification.

U.S. commercial revenue growth of 137% year-over-year in Q4 2025 represents the ninth consecutive quarter of accelerating growth in this segment. Remaining U.S. commercial deal value rose 145% year-over-year to $4.38 billion, indicating a substantial pipeline of contracted future revenue.

Strategic partnerships expand AIP’s market reach through systems integrator relationships. Alliances with Accenture Federal Services announced in 2024 and Deloitte’s establishment of a Palantir Center of Excellence in Arlington, Virginia in July 2025 embed AIP within large-scale delivery footprints across defense, intelligence, and civilian sectors.

Competitive Positioning and Market Comparisons

Palantir operates in enterprise AI software infrastructure with limited direct competitors offering equivalent integrated platforms. The company’s positioning reflects first-mover advantage in operationalizing AI for mission-critical applications.

Microsoft’s Fabric represents the primary alternative, functioning as a developer toolkit rather than an integrated operational system. Snowflake competes in data warehousing but lacks Palantir’s GAAP profitability. UiPath positions in AI agent orchestration at 6 times 2026 sales versus Palantir’s 70 times multiple.

Palantir’s ontology framework—structuring data so AI systems understand real-world context—creates switching costs once enterprises build operational workflows. The dual specialization in classified government operations and commercial applications provides cross-segment knowledge transfer advantages.

Risk Factors and Structural Constraints

PLTR stock investment analysis requires evaluation of multiple risk categories spanning valuation sustainability, customer concentration, competitive threats, and regulatory exposure.

Valuation Compression Risk: The stock’s forward P/E ratio exceeding 170 and price-to-sales ratio near 70 price in sustained growth rates that leave limited margin for execution shortfalls. Any deceleration in revenue growth or adoption of AIP could trigger significant multiple compression. Historical software sector precedents demonstrate that valuation multiples contract rapidly when high-growth companies experience growth rate deceleration.

Customer Concentration Risk: Government contracts represent approximately 50% of total revenue, creating exposure to federal budget cycles, political administration changes, and defense spending priorities. The commercial segment, while growing rapidly, derives substantial revenue from a relatively small number of large enterprise customers. Loss of key accounts or contract non-renewals would materially impact financial performance.

Technology Disruption Risk: The rapid advancement of foundation models and commoditization of AI capabilities could erode Palantir’s competitive moat. Emergence of open-source alternatives or platform-as-a-service offerings from cloud hyperscalers might reduce willingness to pay for integrated software platforms. CEO Alex Karp acknowledged that “in tech, you only have a time horizon of a couple years” and that disruption risk exists even for market leaders.

Regulatory and Geopolitical Risk: Government contracts expose the company to political scrutiny regarding immigration enforcement, defense applications, and data privacy practices. Palantir’s work with U.S. Immigration and Customs Enforcement generated public backlash after federal agents fatally shot protestors in Minneapolis in early 2026. Regulatory restrictions on government AI usage or changes in defense procurement priorities could constrain revenue growth.

Market Sentiment and Momentum Risk: The stock’s 81% gain in 2025 followed by a 15% decline in early 2026 demonstrates high sensitivity to AI sector sentiment and technology stock rotation. Short seller Michael Burry’s disclosed bet against PLTR in November 2025 highlighted valuation concerns among sophisticated investors. Sustained negative sentiment toward high-valuation growth stocks could drive material price declines regardless of operational fundamentals.

Stock-Based Compensation Dilution: While the company achieved GAAP profitability, substantial stock-based compensation expenses create ongoing dilution for existing shareholders. Outstanding shares increased by 6.17% over the past year, partially offsetting earnings growth on a per-share basis.

Strategic Value and Institutional Investment Considerations

PLTR stock’s investment thesis centers on positioning as a critical infrastructure provider for the AI transformation of government operations and enterprise decision-making. The company’s platforms function as operating systems that integrate AI capabilities into existing organizational workflows rather than requiring complete technology stack replacement.

The government segment provides durable, predictable revenue streams with high renewal rates and embedded expansion mechanisms. Defense and intelligence agencies face substantial switching costs once operational workflows are built on Palantir platforms, as classified data integration and mission-critical dependencies create lock-in effects. Increasing global defense spending and prioritization of AI-driven military capabilities support long-term growth in this segment.

The commercial segment exhibits characteristics of a secular growth opportunity as enterprises transition from AI experimentation to production deployment. AIP’s demonstrated ability to generate measurable ROI within days addresses the primary barrier to enterprise AI adoption—uncertainty about value realization timelines and magnitude. The platform’s economics improve with scale, as incremental customer deployments require minimal additional infrastructure investment.

Profitability characteristics distinguish Palantir from many high-growth software companies. GAAP net income margins reached 28% in recent quarters, while operating margins approached 51%. The company generates substantial free cash flow, with projections of $3.93 billion to $4.13 billion for fiscal 2026, providing capital for reinvestment without equity or debt financing requirements.

S&P 500 index inclusion creates structural demand from passive investment strategies. Exchange-traded funds and index mutual funds must maintain PLTR positions proportional to its market capitalization weight, generating systematic buying pressure independent of active investment decisions.

Analyst Perspectives and Price Target Analysis

Wall Street coverage reflects substantial dispersion in valuation perspectives. The consensus “Hold” with targets spanning $50 to $255 illustrates the challenge of valuing a high-growth company at unprecedented multiples.

William Blair and Baird upgraded PLTR to “Outperform” on February 3, 2026, following Q4 earnings. According to analyst coverage, Baird’s $200 target implies 35% upside, citing ten consecutive quarters of earnings acceleration and free cash flow inflection.

RBC issued cautionary commentary on valuation sustainability despite strong results. Goldman Sachs’ estimates were surpassed by 137% U.S. commercial growth. Long-term bullish targets reach $500 within three to five years, assuming sustained 50% earnings growth and premium multiples.

Relationship to Adjacent Equity Investment Concepts

PLTR stock functions as a growth equity with high-margin software characteristics, exhibiting correlation with technology names and sensitivity to growth equity risk premiums. The company represents AI infrastructure exposure distinct from foundation models or semiconductors.

Government contracts provide defense sector exposure without traditional contractor characteristics. While operating subscription revenue similar to SaaS, operational integration depth creates different competitive dynamics. S&P 500 membership creates correlation with broad market movements and exposure to momentum, growth, and quality factors.

Long-Term Structural Significance and Investment Horizon Considerations

The strategic case for PLTR stock centers on positioning within structural technology adoption curves and government modernization imperatives.

Enterprise AI deployment represents a multi-year cycle as organizations move from experiments to production systems. Palantir’s customer base, proven methodology, and demonstrated ROI provide advantages for scaled deployments. Government modernization driven by geopolitical competition positions the company to capture sustained defense budget allocation.

The shift to autonomous decision agents expands addressable markets beyond data analytics. However, even assuming 50% annual EPS growth through 2030, the stock would trade at a forward P/E of 34 if prices remained constant—still a premium to mature software companies. Competitive positioning depends on sustained innovation and maintaining technological leadership as AI capabilities commoditize.

Frequently Asked Questions

What drives PLTR stock price volatility and trading patterns?

PLTR stock exhibits high beta and volatility characteristics driven by its growth equity classification, AI sector sentiment correlation, and substantial retail investor participation. The stock’s price movements respond to quarterly earnings results, changes in analyst recommendations, broader technology sector rotations, and shifts in AI investment themes. Options market activity and short interest dynamics contribute to intraday volatility, particularly during earnings announcement periods.

How does Palantir’s valuation compare to software industry peers?

Palantir trades at significant premiums to software industry averages across multiple valuation metrics. The forward P/E ratio of 170-240 exceeds the software sector average near 27, while the price-to-sales ratio of approximately 70 represents multiples typically reserved for highest-growth, smallest-scale software companies. The valuation implies sustained high-growth expectations and market leadership positioning that creates downside risk if execution falters.

What determines the sustainability of government contract revenue?

Government revenue sustainability depends on defense budget priorities, mission-critical operational dependencies, political administration continuity, and competitive positioning for new contract awards. Palantir’s platforms are embedded in classified intelligence operations and military command-and-control systems with high switching costs. Multi-year contract structures and land-and-expand dynamics within existing accounts provide revenue visibility, though political scrutiny and budget constraints create potential headwinds.

How does AIP commercial adoption translate to financial performance?

AIP commercial adoption drives revenue growth through new customer acquisition and expansion within existing accounts. The bootcamp methodology reduces customer acquisition costs while accelerating sales cycles, improving unit economics compared to traditional enterprise software sales models. Triple-digit commercial revenue growth rates reflect early-stage market penetration, though sustainability of these growth rates requires continued market share gains and successful expansion into mid-market customer segments.

What are the primary competitive threats to Palantir’s market position?

Primary competitive threats include platform offerings from Microsoft, commoditization of AI capabilities through open-source alternatives, and potential disruption from cloud hyperscalers integrating competing functionality into infrastructure-as-a-service offerings. Palantir’s competitive moat depends on maintaining differentiation through ontology frameworks, operational integration depth, and security certifications required for government classified work. Technology disruption risk exists as AI foundation models advance and may reduce dependency on integrated platforms.

How do valuation metrics inform investment decision frameworks?

Valuation metrics provide context for expected return scenarios under different growth and multiple compression assumptions. The current valuation implies that substantial growth is already priced into the stock, limiting upside unless growth accelerates further or the market assigns even higher multiples. Investment decisions require probabilistic assessment of growth sustainability, competitive positioning maintenance, and valuation normalization timing. Traditional value investment frameworks would classify PLTR as substantially overvalued, while growth investment approaches focus on absolute growth rates and market opportunity scale.

Key Takeaways

PLTR stock represents a high-valuation, high-growth equity investment in AI software infrastructure with dual revenue streams from government defense contracts and commercial enterprise customers, trading at forward P/E ratios exceeding 170 and price-to-sales multiples near 70 that imply sustained exceptional growth expectations.

The company reported Q4 2025 revenue of $1.41 billion with 70% year-over-year growth and U.S. commercial revenue growth of 137%, while guiding fiscal 2026 revenue to $7.18-7.20 billion, substantially above prior analyst expectations, demonstrating accelerating adoption of its Artificial Intelligence Platform.

Long-term government contracts including the $10 billion U.S. Army Enterprise Agreement and $1.3 billion Maven Smart System provide durable revenue streams with high renewal rates, while the commercial AIP platform enables enterprises to deploy AI decision agents with demonstrated ROI within five-day bootcamp cycles.

Investment risk analysis must account for valuation compression potential, customer concentration exposure, technology disruption threats, and the fact that even aggressive growth scenarios imply limited upside from current price levels unless growth accelerates beyond already-elevated expectations or valuation multiples expand further from historical norms.