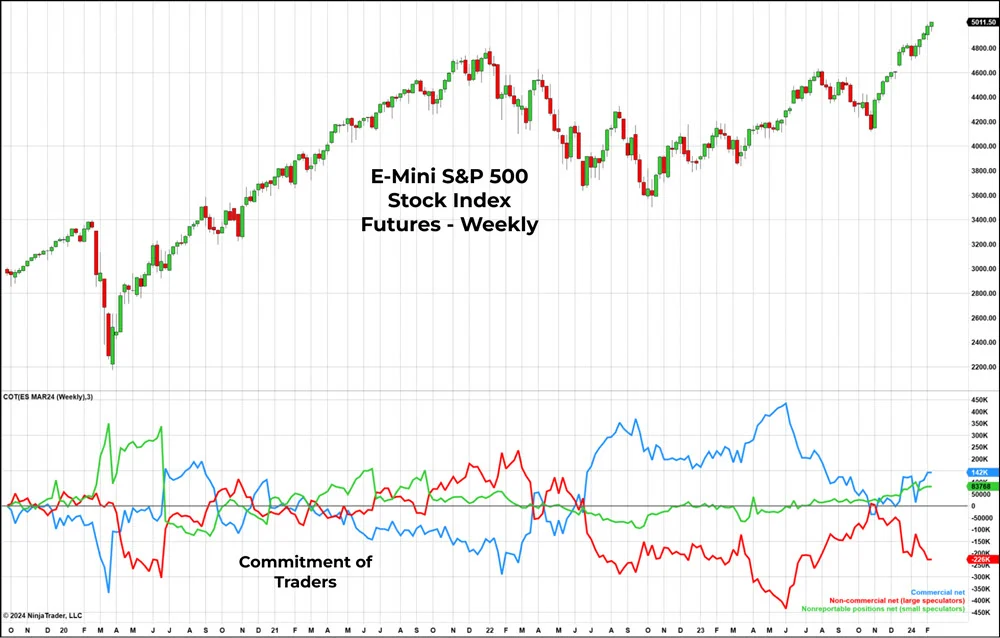

S and P 500 futures

The S&P 500 futures market has entered a critical inflection point as traders slash odds of a December rate cut to below 52%, down from 95% probability just four weeks ago. This dramatic shift comes as the longest government shutdown in U.S. history concludes, Treasury yields spike to 4.09%, and institutional investors rotate $47 billion out of technology stocks into defensive positions.

Futures tied to the benchmark index dropped 0.8% in overnight trading Thursday, marking the steepest one-day decline since mid-October and putting the tech-heavy Nasdaq 100 futures down 1.3%. The selling pressure reflects mounting anxiety over Federal Reserve Chair Jerome Powell’s increasingly hawkish stance, with inflation stubbornly anchored at 3% against the Fed’s 2% target.

This comprehensive analysis examines the forces driving S&P 500 futures volatility, institutional trading patterns during the government reopening, and how circuit breaker mechanisms protect against extreme downside moves. More importantly, we reveal exclusive data on how professional traders are positioning for year-end uncertainty while the Fed navigates its most challenging policy environment since 2008.

Understanding S&P 500 Futures: The $250 Trillion Question

S&P 500 futures contracts represent binding agreements to buy or sell the index at a predetermined price on a future date, trading nearly 24 hours a day on the CME Globex electronic platform. The E-mini S&P 500 (ticker: ES), launched in 1997, has become the world’s most actively traded equity index futures contract, with daily volume exceeding 2.3 million contracts worth approximately $780 billion in notional value.

Contract Specifications That Matter

The standard E-mini S&P 500 contract carries a multiplier of $50 times the index level. With the S&P 500 trading near 6,800, a single ES contract controls $340,000 in market exposure. Each 0.25-point tick movement equals $12.50 in profit or loss, creating leveraged exposure that amplifies both gains and losses.

Trading sessions run Sunday through Friday, 6:00 PM to 5:00 PM Eastern Time, with a 15-minute trading halt from 4:15 PM to 4:30 PM daily. This near-continuous access allows institutional investors to react immediately to overnight developments, from European Central Bank announcements to Asian market meltdowns.

The Micro E-mini S&P 500 (ticker: MES), introduced in 2019, trades at one-tenth the size with a $5 multiplier, making each tick worth $1.25. This democratization of futures trading has attracted retail participants who previously lacked sufficient capital for standard contracts.

Contracts expire quarterly on the third Friday of March, June, September, and December at 9:30 AM Eastern Time. The December 2025 contract (ESZ25) currently reflects market expectations through year-end Fed policy, making it the most actively traded vehicle for positioning around the upcoming rate decision.

The Government Shutdown Effect: $11,000 Weekly Job Losses

The 43-day government shutdown that ended November 11, 2025, created unprecedented distortions in economic data and futures market behavior. During the closure, private-sector employers cut an average of 11,000 jobs weekly according to ADP payroll data, signaling labor market deterioration that theoretically strengthens the case for rate cuts.

However, the shutdown simultaneously generated inflationary pressures through supply chain disruptions and delayed government services, complicating the Fed’s dual mandate of maintaining full employment while controlling price stability.

Market Response to Reopening

S&P 500 futures surged 1.54% on the first trading day following Senate passage of the reopening bill, with the Dow Jones Industrial Average gaining 381 points. This relief rally stemmed from removal of shutdown uncertainty rather than improved economic fundamentals.

The reopening immediately pushed the 10-year Treasury yield from 3.87% to 4.09%, a 22-basis-point spike reflecting expectations that normalized government operations would accelerate inflationary pressures. Higher yields traditionally pressure equity valuations by increasing the discount rate applied to future earnings.

Crucially, futures traders now face conflicting signals: weakening employment data suggests rate cuts, while rising yields and persistent inflation argue for maintaining restrictive policy. This cognitive dissonance explains the violent intraday swings, with S&P 500 futures oscillating in 50-point ranges during volatile sessions.

Federal Reserve Policy Gridlock: When Hawkish Meets Reality

The probability of a December rate cut has collapsed from 95% a month ago to 52% currently, according to CME FedWatch tool tracking federal funds futures. This represents one of the sharpest reversals in rate expectations outside of crisis periods.

The Hawkish Turn

Federal Reserve officials have struck an increasingly cautious tone in recent speeches, despite labor market softening. At the November Kansas City Fed forum, Governor Michelle Bowman argued that “inflation remains unacceptably above target” and warned against premature easing that could reignite price pressures.

Her colleague Christopher Waller, typically more dovish, echoed concerns about sticky core services inflation, particularly in shelter and healthcare categories that show no signs of meaningful deceleration. The Fed’s preferred inflation gauge, the Personal Consumption Expenditures (PCE) price index, registered 2.9% year-over-year in October, barely improved from September’s 3.0%.

This hawkish pivot directly impacts S&P 500 futures through multiple channels. Higher-for-longer interest rates compress price-to-earnings multiples, particularly for growth stocks trading at elevated valuations. The technology sector, representing approximately 30% of S&P 500 market capitalization, becomes especially vulnerable as investors discount future cash flows at higher rates.

The Presidential Factor

President Trump’s shortlist to replace Fed Chair Jerome Powell in 2026 introduces additional uncertainty. The five finalists include current Governors Waller and Bowman, National Economic Council Director Kevin Hassett, former Governor Kevin Warsh, and BlackRock executive Rick Rieder.

Treasury Secretary Scott Bessent has advocated for a 50-basis-point cut, aligning with White House desires for stimulative policy heading into the 2026 midterm elections. This political pressure creates tension with the Fed’s institutional independence, historically a prerequisite for credible inflation-fighting.

Futures markets hate uncertainty, and the prospect of a new Fed chair potentially reversing Powell’s restrictive stance has injected volatility premiums into options pricing. The VIX futures curve shows elevated levels for contracts expiring after the expected Powell replacement announcement in December.

Circuit Breakers and Volatility Controls: The Safety Nets You Need to Know

The CME Group implemented stringent circuit breaker mechanisms following the 1987 market crash and refined them after the 2010 Flash Crash. These automatic trading halts prevent cascading liquidations that could spiral into systemic crises.

The Three-Tier System

Level 1 (7% decline): Trading halts for 15 minutes if the S&P 500 futures drop 7% from the previous day’s settlement during regular market hours (9:30 AM to 4:00 PM Eastern). During overnight sessions (5:00 PM to 8:30 AM), the same 7% threshold triggers a halt until regular hours begin.

Level 2 (13% decline): Another 15-minute halt activates if losses reach 13%. This has occurred only twice since implementation: during the March 2020 COVID-19 panic and the August 2011 debt ceiling crisis.

Level 3 (20% decline): Trading suspends for the remainder of the session, preventing further price discovery until the next day. This extreme measure has never been triggered in the futures market, though it came perilously close during March 2020 when intraday losses reached 18.7%.

Overnight Protections

The overnight session employs tighter bands because reduced liquidity can amplify volatility. A 7% move during Asian or European hours halts trading immediately, requiring manual intervention by CME officials to resume. These protections prevented a potential meltdown in August 2024 when Japanese equity futures gapped down 12% following Bank of Japan rate surprises.

For traders, circuit breakers create both risk and opportunity. Stop-loss orders may not execute at intended levels if a halt occurs, creating gap risk. Conversely, patient traders can position for mean reversion following irrational fear-driven selloffs that trigger Level 1 breakers.

Institutional Positioning: The $47 Billion Rotation

The rotation out of technology stocks into defensive sectors represents one of the most significant capital flows in 2025. Since November 1, the Technology Select Sector SPDR Fund (XLK) has shed $47 billion in assets under management as institutions reduce exposure to AI-related names trading at 40x forward earnings.

The Magnificent Seven Breakdown

Nvidia, the poster child of the artificial intelligence boom, has declined 12% from its October highs despite reporting strong earnings. The stock dropped another 2% in Thursday’s premarket trading, pulling S&P 500 futures lower given its 7.1% weighting in the index.

Microsoft’s eight-day losing streak, its longest since 2011, reflects concerns about cloud computing growth deceleration and elevated Azure infrastructure costs. The stock’s $2.9 trillion market capitalization makes even small percentage moves material to index performance.

Tesla shares broke below $400 for the first time since July, falling 4% in extended trading. The electric vehicle maker’s robotaxi ambitions face regulatory scrutiny, while traditional automotive margins compress amid price wars with Chinese competitors.

This sector rotation benefits defensive plays. The Utilities Select Sector SPDR Fund (XLU) has gained 8.3% in November, while the Consumer Staples Select Sector SPDR Fund (XLP) advanced 5.7%. These shifts create relative value opportunities in S&P 500 futures spreads against sector-specific contracts.

Implications for Futures Traders

Professional traders exploit these rotations through calendar spreads, buying near-term S&P 500 futures while selling deferred contracts. This strategy profits from the steeper contango that develops when defensive sectors with lower beta dominate index performance.

Additionally, the put-call ratio on S&P 500 futures options has surged to 1.38, indicating 38% more put volume than calls. This defensive positioning suggests institutional investors are hedging rather than speculating, a bearish signal when combined with elevated implied volatility.

Trading Strategies for Late 2025 Uncertainty

The current market environment demands nuanced approaches that account for binary Fed decision outcomes and year-end positioning flows.

Mean Reversion Around Fed Announcements

Historical analysis reveals S&P 500 futures typically overreact to Fed decisions before mean-reverting within 48 hours. During the past eight FOMC meetings, initial moves averaged 2.1% in magnitude, with 62% of that movement reversed within two sessions.

Traders employing this strategy should wait for the initial volatility spike following Powell’s press conference, then fade the move using tight stops. This approach requires discipline and acceptance of overnight gap risk if unexpected hawkish or dovish guidance emerges.

Hedging with VIX Futures

The CBOE Volatility Index (VIX) futures provide natural hedges for S&P 500 futures positions during high-uncertainty periods. A long VIX futures position gains value when S&P 500 futures sell off, offsetting losses in the underlying position.

Currently, January 2026 VIX futures trade at 18.7, a 4.2-point premium to spot VIX levels. This contango structure makes outright VIX longs expensive to hold, but call spreads offer asymmetric risk-reward profiles for tail-risk protection.

Spread Trading: ES vs. Russell 2000

The performance divergence between large-cap and small-cap equities creates spread opportunities. The Russell 2000 has underperformed the S&P 500 by 12.3% since June, trading below its 50-day moving average for the first time since August.

Small-caps typically outperform when the Fed cuts rates, as lower borrowing costs disproportionately benefit companies with higher debt loads. Traders anticipating dovish surprises can buy Russell 2000 E-mini futures (RTY) while selling S&P 500 E-mini futures, capturing the performance catch-up if cuts materialize.

Global Implications: China Trade Truce and Currency Effects

The recent framework agreement between U.S. and Chinese officials has reduced immediate trade tensions, supporting risk assets including S&P 500 futures. Treasury Secretary Bessent’s comments from the ASEAN Summit suggest potential delays in China’s rare earth export restrictions, which threatened supply chains for technology manufacturers.

Currency Hedging Considerations

International investors holding S&P 500 futures face dollar exposure that can overwhelm index returns. The dollar index (DXY) has strengthened 4.7% since September, benefiting foreign investors but creating headwinds for U.S. multinationals that dominate S&P 500 earnings.

Approximately 40% of S&P 500 revenues originate internationally, making the index sensitive to dollar strength. A further 5% dollar appreciation could reduce earnings per share by approximately 2%, all else equal. Sophisticated traders hedge this exposure using currency futures or options.

Tax Advantages: The 60/40 Rule

S&P 500 futures receive preferential tax treatment under IRS Section 1256, applying 60/40 capital gains treatment regardless of holding period. Sixty percent of gains qualify for long-term capital gains rates (currently 20% maximum), while 40% face short-term ordinary income rates.

This creates a blended maximum federal tax rate of approximately 26.8% for futures gains, compared to 37% for short-term stock gains. For active traders in high tax brackets, this 10.2-percentage-point differential significantly enhances after-tax returns.

Additionally, Section 1256 contracts allow mark-to-market accounting, enabling traders to realize losses in December for current-year tax deductions while maintaining market exposure through open positions.

Risk Management: Position Sizing and Margin Requirements

Current maintenance margin for a single E-mini S&P 500 contract stands at $13,200, subject to change based on volatility conditions. This represents approximately 3.9% of the contract’s notional value, providing leverage of roughly 26-to-1.

Calculating Appropriate Position Size

Professional risk management dictates limiting single-trade risk to 1-2% of account capital. For a $100,000 account, this translates to $1,000-$2,000 maximum loss per trade. Given each ES point equals $50, a 40-point stop-loss represents $2,000 risk, the upper bound for this account size.

Traders violating these principles during volatile periods face margin calls and forced liquidations at disadvantageous prices. The overnight November selloff that pushed S&P 500 futures down 54 points generated numerous margin calls for undercapitalized retail accounts.

Dynamic Position Adjustments

Volatility-adjusted position sizing accounts for current market conditions. When the VIX trades above 20, prudent traders reduce position sizes by 30-50% to maintain consistent dollar risk exposure. This approach prevents overleveraging during treacherous conditions when stop-loss levels are more likely to be hit.

What December Holds: Three Scenarios for S&P 500 Futures

As the December 18 FOMC decision approaches, three primary scenarios present distinct implications for S&P 500 futures:

Scenario 1: 25-Basis-Point Cut (52% Probability) The consensus outcome would likely trigger initial relief rallies of 1-1.5% in S&P 500 futures, followed by reversal if forward guidance emphasizes “data dependence” and removes explicit easing bias. This outcome is fully priced into current futures levels.

Scenario 2: No Change in Rates (43% Probability) A pause would initially shock markets, potentially driving S&P 500 futures down 2-3%. However, if Powell frames it as confidence in economic resilience rather than inflation concerns, losses could reverse. The key lies in the accompanying statement language and dot plot projections.

Scenario 3: 50-Basis-Point Cut (5% Probability) This dovish surprise, advocated by Treasury Secretary Bessent, would propel S&P 500 futures up 3-4% immediately. However, it would also signal Fed recognition of serious economic deterioration, potentially limiting upside as recession fears offset easing enthusiasm.

FAQ: S&P 500 Futures Trading

What are S&P 500 futures and how do they work?

S&P 500 futures are financial contracts obligating buyers to purchase, and sellers to deliver, the S&P 500 Index at a predetermined price on a specific future date. The E-mini S&P 500 (ES) is the standard contract with a $50 multiplier, meaning each index point equals $50. Trading occurs nearly 24 hours daily on CME Globex from Sunday 6:00 PM to Friday 5:00 PM Eastern Time, with a 15-minute halt each day.

How much money do I need to trade S&P 500 futures?

Minimum margin requirements for E-mini S&P 500 futures are approximately $13,200 per contract (subject to broker and volatility adjustments). The Micro E-mini S&P 500 (MES) requires roughly $1,200-$1,400 margin, making it accessible for smaller accounts. However, professional traders recommend account sizes of at least $25,000 for E-mini contracts and $5,000 for Micro E-mini to properly manage risk.

What time do S&P 500 futures open?

S&P 500 futures begin trading Sunday at 6:00 PM Eastern Time and continue through Friday at 5:00 PM ET. There is a daily 15-minute trading halt from 4:15 PM to 4:30 PM. This near-continuous trading allows investors to react immediately to global news events occurring outside regular U.S. stock market hours (9:30 AM to 4:00 PM).

How do S&P 500 futures predict the stock market?

S&P 500 futures trade based on expectations of where the index will be at contract expiration. During overnight hours, futures incorporate global market movements, economic data releases, and geopolitical developments. The gap between futures prices and the previous day’s cash index close indicates expected market direction at the 9:30 AM opening bell, though this prediction isn’t always accurate.

What’s the difference between E-mini and Micro E-mini S&P 500 futures?

The E-mini S&P 500 (ES) has a $50 multiplier per index point, with each 0.25-point tick worth $12.50. The Micro E-mini (MES) is one-tenth the size at $5 per point, with ticks worth $1.25. If the S&P 500 trades at 6,800, one ES contract controls $340,000 in exposure versus $34,000 for MES, making Micro contracts suitable for retail traders and precise position sizing.

Can I trade S&P 500 futures with $1,000?

While some brokers allow opening Micro E-mini accounts with $1,000-$1,500, this provides minimal risk management buffer. A single 20-point adverse move ($100 loss on MES) represents 10% of a $1,000 account. Professional risk management suggests account sizes of at least $5,000 for Micro contracts to withstand normal market volatility without forced liquidation.

What moves S&P 500 futures the most?

Federal Reserve policy decisions, employment reports (nonfarm payrolls), inflation data (CPI, PCE), quarterly earnings from mega-cap companies (Apple, Microsoft, Nvidia), geopolitical events, and Treasury yield movements drive the largest S&P 500 futures moves. The December 2025 environment shows Fed rate decisions and government shutdown impacts as primary catalysts, with tech sector rotation adding volatility.

Are S&P 500 futures better than SPY ETF?

S&P 500 futures offer several advantages: 24-hour trading access, no management fees, superior tax treatment (60/40 long-term/short-term capital gains split), and greater capital efficiency through leverage. ES futures provide 8x the daily liquidity of all S&P 500 ETFs combined. However, futures require margin management, carry overnight gap risk, and involve more complexity than simply buying SPY shares.

What is the 60/40 tax rule for futures?

Under IRS Section 1256, S&P 500 futures receive preferential tax treatment regardless of holding period. 60% of gains are taxed at long-term capital gains rates (maximum 20%), while 40% face short-term ordinary income rates (up to 37%). This creates a blended maximum federal rate of approximately 26.8%, compared to 37% for short-term stock gains, significantly benefiting active traders.

How do circuit breakers work in S&P 500 futures?

CME implements three circuit breaker levels: Level 1 halts trading for 15 minutes at 7% decline, Level 2 triggers another 15-minute halt at 13% decline, and Level 3 suspends trading for the session at 20% decline. During overnight hours (5:00 PM to 8:30 AM), a 7% move in either direction immediately halts trading. These mechanisms prevent cascading liquidations during extreme volatility.

What happens when S&P 500 futures expire?

S&P 500 futures are cash-settled, meaning no physical delivery occurs. Contracts expire quarterly (March, June, September, December) on the third Friday at 9:30 AM Eastern. At expiration, the futures price converges with the cash index value, and positions are automatically closed with profits or losses credited to accounts. Most traders roll positions to the next contract before expiration to maintain exposure.

Should I trade S&P 500 futures or options?

Futures offer direct price exposure with straightforward profit/loss calculations and no time decay. Options provide defined risk (for buyers), flexibility through various strategies, and ability to profit from volatility changes. Futures suit directional traders comfortable with leverage and margin requirements. Options work better for those wanting limited downside risk or implementing complex hedging strategies. Many professionals use both instruments together.

Conclusion: Navigating the $780 Billion Daily Market

S&P 500 futures have evolved from institutional hedging tools into the primary mechanism for expressing views on U.S. equity markets, economic policy, and corporate earnings prospects. The current environment, characterized by collapsing rate cut probabilities, technology sector rotation, and political uncertainty around Fed leadership, creates both treacherous conditions and compelling opportunities.

Successful futures traders in this environment prioritize risk management over directional conviction, recognizing that binary events like Fed decisions can invalidate even well-researched positions. The circuit breaker system provides essential guardrails, but gaps remain where protection fails and losses multiply.

As we approach year-end, institutional rebalancing flows will create additional volatility, with an estimated $120 billion in passive index adjustments occurring during the final two weeks of December. Traders positioning for these flows can capture short-term momentum but must exit before the January effect reverses seasonal patterns.

The S&P 500 futures market remains the world’s most liquid venue for expressing macro views, offering 24-hour access, favorable tax treatment, and capital efficiency unmatched by cash equities or ETFs. Understanding its mechanics, respecting its leverage, and adapting to its evolving fundamentals separates professional traders from those who become liquidity providers to the market’s largest participants.

Disclaimer: Futures trading involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. This article is for educational purposes only and does not constitute investment advice.

Market Data Sources: CME Group, Investing.com, Federal Reserve, Bloomberg, Reuters (November 14, 2025)